Adjusting to new realities and finding ways to maximize revenues amid the “explosion of screens” in AsiaPac were key themes at the tenth edition of the APOS Summit in Bali, which featured local, regional and global media executives weighing in on consolidation, shifting business models and content trends.

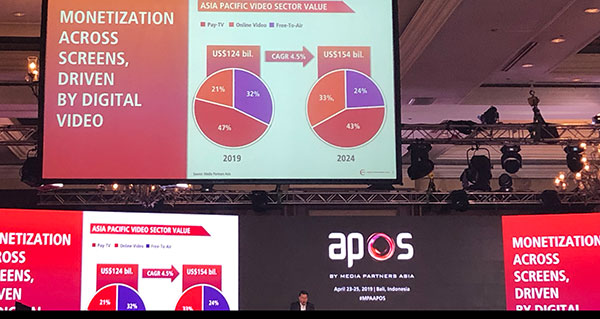

Organized by Media Partners Asia (MPA), APOS opened with Vivek Couto, the organization’s executive director, laying out the major issues at play in the AsiaPac media sector. An “explosion of screens,” led by increased mobile connectivity, will drive gains in AsiaPac video revenues over the next five years, Couto said in his opening remarks. Total video industry revenues in the region will rise by 5 percent every year for the next five years, Couto said, to reach $154 billion. Online services will account for more than a third of that in five years’ time versus 18 percent today. “China remains at the forefront in terms of scale and monetization” in online video, Couto noted. “But monetization of video across millions of mobile screens is starting to scale in other markets. We have the beginnings of a digital ecosystem.”

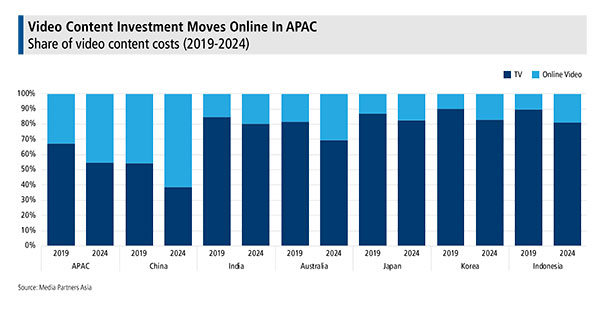

Video content investment will see a moderate pace of growth, “as budgets rationalize across free and pay TV, especially on third-party content and to some extent sports rights. Online video content spend, meanwhile, will climb 10 percent every year over the next five years to reach $33 billion, driven by growth across the region, as well as cost inflation of Asian entertainment, sports rights and Hollywood content. China is the clear leader—$27 billion spent on online video content over the next five years, followed by Japan and India.”

Revenues from online video subscriptions and advertising across the Asia Pacific will hit $52 billion in 2024, MPA says, double the $26 billion forecast for this year. Strategies for scoring—and keeping—a share of that pie were on the agenda throughout the week. The importance of Asia’s expanding media ecosystem to global media companies was touted by many leading executives. Kevin Mayer, the chairman of direct-to-consumer and international at The Walt Disney Company, discussed Asia as a growth driver and shared the strategy behind Disney+ in his APOS session.

“Going all in on a new business model and disrupting your current business is not taken lightly,” Mayer said of Disney’s bet on direct-to-consumer. “The only way to really get data on people’s affinities and usage patterns and viewing patterns is to have a direct relationship with them. We can use that data to personalize the experience and serve the consumer better. Also, it’s a big financial growth strategy. There was a whole part of the value chain that we were leaving to third parties.”

The session ended with Mayer discussing the “balancing act” between Disney+’s international rollout and the company’s traditional television business around the world. “One of the reasons we put direct-to-consumer and international in the same organization was so we could make the decision as to where that balancing act should lie. I think you’ll see a shift over time. The direct-to-consumer business has to be robust, we’re going all in, but we’re trying to have a substantial and growing traditional television business for the foreseeable future as well.”

The Wednesday set of keynotes also saw Molly Battin, executive VP of WarnerMedia, weighing in on the importance of scale, the merger with AT&T and the restructure of HBO, Turner and Warner Bros. “It’s about combining the power of platforms, brands, storytelling, innovation and data, and doing it in a way that creates massive scale in the marketplace, and really helps us to supercharge our strategy around reimagining this television ecosystem,” Battin said. Greg Hart, VP, worldwide, at Amazon Prime Video, discussed consumer engagement and partnerships with distribution platforms. The Wednesday keynotes also included Viacom’s David Lynn discussing the transformation of the company’s positioning domestically and internationally, with a new three-tier distribution strategy for its channel brands, increased activity with mobile partners and a pivot towards content creation for third-party outlets, in addition to its slate for its own channels. (Viacom International Media unveiled a slew of new original shows in Southeast Asia at APOS.) Sony Pictures Television’s Mike Hopkins was also on hand to reflect on his strategy for the company and its focus on content creation.

A raft of content sessions took place Thursday, including Netflix’s Melissa Cobb discussing the streamer’s strategy for original animation, and Wattpad’s Allen Lau on how the storytelling platform is ramping up its alliances with producers, distributors and broadcasters worldwide, such as its recent deal with Singapore’s Mediacorp. The Singaporean media group is also working with VICE, which made several announcements at APOS; the company’s executive chairman, Shane Smith, was on site in Bali as the youth media company bets big on Asian expansion. In addition to the Mediacorp deal, VICE revealed it had tapped Joon Lee’s LYD to serve as its representative in Korea as it looks to bring its content to TV and digital platforms across the country, and announced a pact with China’s Tencent Video on a series exploring “hype culture” around the world.

Speaking of Chinese OTT, Yang Xianghua, president of membership and overseas business group at iQiyi, talked about the platform’s success and its international ambitions at APOS. Indian OTT was also in the spotlight in several sessions, including a look at Hotstar—which Disney’s Mayer referred to as a “crown jewel” of the 21st Century Fox acquisition—and ZEE5, which is rolling out internationally in multiple languages. India is key to Snap’s international ambitions, Nana Murugesan, managing director of international markets, told APOS delegates. The company has 190 million daily active users worldwide. In India, the company has signed up 20 content partners and has localized in four languages. The company is exploring telco and device partnerships in India and focusing on tentpoles like cricket and this year’s elections. It also localized in four languages in Southeast Asia.

The importance of partnerships was a key theme of the week, especially for OTT platforms. The Australian entertainment service Fetch TV will add Amazon Prime Video and 10 All Access to its platform this year. HBO GO will become available in Malaysia this May exclusively through Astro.

The increasing value of local content also dominated headlines. BBC Studios announced a trio of format adaptations from its slate: Luther in India, Dancing with the Stars in Myanmar and The Great Bake Off in Thailand. Discovery unveiled three co-productions with digital platforms in China, including a local version of the Say Yes franchise with China Mobile’s Migu.

Regional OTT platforms iflix, HOOQ and Viu all stressed the importance of Asian content to their build-outs. iflix inked a content deal with Malaysia’s Media Prima and content and equity deals with JTBC in Korea and MNC in Indonesia. HOOQ is dramatically expanding its lineup of original series, announcing plans to create 100 more this year across a range of genres. PCCW’s Viu plans to release more than 80 original scripted and non-scripted shows this year from Hong Kong, Malaysia, Thailand, Indonesia, India, the Philippines and the Middle East.

The event wrapped with HBO Asia’s traditional closing party (with some revelers wondering if this was the last one, given changes at its U.S. parent), where attendees flocked to take pictures with the “White Walkers” that were brought out mid-festivities at the Game of Thrones-themed event. As pay-TV platforms feel the cord-cutting squeeze, channels get dropped and upstart OTT platforms burn through their shareholders’ cash, it certainly feels like “winter is coming”—or, perhaps, winter is already here. But for all the challenges—including the neverending scourge of piracy—there are paths to riches for those who can navigate AsiaPac’s shifting media landscape. “The growth of broadband connectivity and digital video platforms is driving new economic value for content creators, aggregators and sports-rights owners at a global and local level, helping seed digital ecosystems,” Couto said. “Meanwhile, a still lucrative legacy-TV industry continues on a low-growth trajectory in many markets, although under increasing pressure. In certain markets, the value erosion across legacy TV is unlikely to be replaced over the medium term but digital video monetization will grow and margins will recover as costs recalibrate.”

TVASIA

TVASIA