Netflix reported first-quarter revenues of $10.5 billion, an increase of 12.5 percent on the year-ago period, with a net income of $2.9 billion.

Revenues and operating income were ahead of guidance thanks to increased subscription and ad revenues and the timing of expenses. North America and Canada contributed revenues of $4.6 billion, a 9 percent gain. EMEA revenues were up 15 percent to $3.4 billion. LatAm revenues increased 8 percent to $1.3 billion. AsiaPac saw a double-digit gain of 23 percent to $1.3 billion.

“We’re executing on our 2025 priorities: improving our series and film offering and growing our ads business; further developing newer initiatives like live programming and games; and sustaining healthy revenue and profit growth,” the streaming giant said in its letter to shareholders.

Q2 revenues are expected to be up 15 percent, boosted by price changes and continued subscription and ad revenue gains, with 2025 revenues on track to reach between $43.5 billion and $44.5 billion.

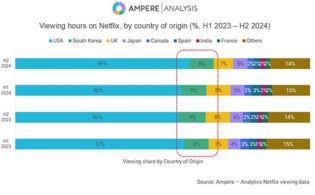

Netflix estimates its global audience to be about 700 million, with more than two-thirds of that being outside of the U.S. In its letter to shareholders, it stressed its commitment to driving local storytelling.

“No entertainment company has ever programmed for so many tastes, cultures and languages. Consumers have so many amazing entertainment choices—our business remains intensely competitive. To grow around the world and to delight and satisfy such a large and diverse audience, our strategy is to continuously improve and expand our entertainment offering, starting with great shows and movies from across the globe that first and foremost appeal directly to local audiences because we believe they want to see authentic stories. We then make it easy for anyone, anywhere to watch them. To do this well, it takes not just long-term commitment and focus, but teams on the ground that understand local tastes and cultures. We have offices around the world with local executives who have deep relationships with the creative and business communities. And we have invested in production infrastructure to create high-quality series and films. We started building this muscle nearly a decade ago with Club de Cuervos from Mexico and we’re now producing in over 50 countries.”

The letter continues, “While the majority of our content spend and production infrastructure investment is in the U.S., we now also spend billions of dollars per year making programming abroad. And instead of just licensing local titles, we’re now making local shows and films in many countries, commissioned by our local executives, that keep our members happy. And our local slates are improving each year.”

Boosting its engagement with the ad community is also a key priority for this year, driven by the April 1 arrival of its in-house ad-tech platform, Netflix Ads Suite, in the U.S., with an international rollout to follow. “We believe our ad tech platform is foundational to our long-term ads strategy. Over time, it will enable us to offer better measurement, enhanced targeting, innovative ad formats and expanded programmatic capabilities. In Q1, we launched programmatic in EMEA, and now offer programmatic capability in UCAN, EMEA and LATAM, with a full APAC launch coming in Q2. Additionally, we continue to build out our infrastructure and invest in resources that will help to better serve our ads clients.”

Netflix also revealed that founder Reed Hastings is transitioning from executive chairman to board chair and non-executive director.