The recently merged Warner Bros. Discovery, consisting of WarnerMedia and Discovery, Inc., has frequently made headlines in the past months. Much attention has been given to content production, financial earnings and the upcoming joint streaming service, comprised of HBO Max and discovery+, set to launch next year. Yet, one sizable division of Warner Bros. Discovery has remained under the radar even as its brands continue to generate revenues and satisfy viewers.

Gerhard Zeiler, president of international, oversees businesses in more than 200 countries and territories. They include Discovery Channel, discovery+, CNN, Eurosport, HBO, HBO Max, HGTV, Food Network, Cartoon Network and many more. He also has joint responsibility for direct-to-consumer in international markets and oversees local theatrical production and acquisitions.

Though viewers are opting to watch programming on streaming platforms rather than linear channels, the rate of that migration varies from one region of the world to another. As Zeiler tells World Screen, linear television is not dead, and several brands in his portfolio are drawing significant viewership.

With 30-plus pay-TV networks, six consistently among the top ten, Warner Bros. Discovery is the most successful U.S.-headquartered company in Latin America. And between its pay- and free-TV channels, the company is the second-largest broadcast group in Europe.

Eurosport is the leading pan-regional sports destination in Europe, and Warner Bros. Discovery’s sports channels, platforms and brands collectively reach roughly 130 million people outside the U.S. every month.

The international businesses not only contribute to the bottom line but they also form the foundations for valuable long-term relationships and incubators of talent. Zeiler, who previously held the positions of president of international and chief revenue officer at WarnerMedia, president of Turner International, and CEO of RTL Group, believes in the importance of the local mindset—understanding local economies, cultures and tastes.

Zeiler reiterates what David Zaslav, president and CEO of Warner Bros. Discovery, stated recently: subscriber numbers are not the only factor in measuring success. To that end, the company is still in the business of selling its content to third parties. Zeiler also believes in offering consumers the broadest range of entertainment options across theatrical, home entertainment, streaming, premium pay, pay- and free-to-air networks, gaming, consumer products and experiences.

Zeiler talks to World Screen about the strong performance of Warner Bros. Discovery’s international channels, feature films and windowing, the company’s evolving streaming strategy, and serving advertisers and consumers.

WS: How important are international businesses to Warner Bros. Discovery?

ZEILER: Warner Bros. Discovery is a global company. The international part of the business is, therefore, naturally important. A significant portion of our company’s revenues come from markets outside the U.S. But even more important, from my point of view, is that through the international businesses, we serve all our consumers across all the platforms. We are invested in theatrical, home entertainment, streaming, premium pay, pay TV, free-to-air networks, gaming, consumer products and experiences. We offer all of that to the consumer. To say it simply: We are not a one-trick pony. I believe this broad spectrum of services we can offer—which only a few other companies can—gives us a competitive advantage. But let me add one thought: To be successful as a global player, you must also have a strong local mindset. You know my opinion about that—regardless of where I have worked, I always thought that way. Without the knowledge of the local economies, the local cultures and the local tastes, you can’t be a winner. That’s what makes our international businesses important for the whole company.

WS: What challenges and opportunities do you see for the company internationally?

ZEILER: Let’s start with the smallest of our regions, Asia Pacific. If you want to be a global player, you can’t neglect this region. The biggest challenge is that the Asia Pacific is not one region; it’s at least six: Japan, Korea, India, Australia and New Zealand, the markets of Southeast Asia and let’s not forget China. They are all so different in terms of language, culture, religion and regulation. It requires us to offer the consumer a local proposition that suits their culture and tastes. Yes, U.S. content is very popular in Asia, and the latest successes of our feature films show that. Australia was in the top three markets for The Batman outside the U.S., as was China, despite the fact that 50 percent of movie theaters were closed because of Covid at the time of the movie’s premiere. Look at Elvis: Australia was the number two market outside the U.S. And last but not least, Fantastic Beasts: The Secrets of Dumbledore: Japan was number one outside the U.S., and China was number three.

But if you want to be successful in Asia, U.S. content alone is not sufficient. Therefore, we have to invest in local content. I will give you two examples from Japan. In the last ten years, we have been producing successful local feature films and anime shows. Last year alone, Japanese local feature films grossed almost $50 million at the local box office in Japan. These examples show that the Asia Pacific is a growing source of great storytelling; we want to and will be part of it. Last but not least, we have the biggest commercial player in New Zealand with Three.

Latin America was a stronghold for WarnerMedia and a stronghold for Discovery. Combined, the performance of our business in the region is great. We have 36 linear pay-TV networks, [spanning] general entertainment, factual, lifestyle, sports and news. And even more important than the volume and number of linear networks is the fact that six of them—TNT, Cartoon Network, Discovery Kids, Warner TV, Discovery Channel and Space—are within the top ten pay-TV networks in the region, which makes us the most successful U.S. media company in Latin America. We also invested in sports. Together with Fox [Sports], five years ago, we acquired the rights for the Argentina Primera División for ten years. We did it on our own in Chile two years later and acquired the Chilean Primera División for 15 years.

Last but not least, a word about our streaming business. We have HBO Max [performing] very successfully in Latin America and discovery+ in Brazil. To summarize: Latin America is a very strong region for Warner Bros. Discovery. Yes, it has not always been a region of stability, but our management knows how to deal with that.

Our biggest region is Europe. Not many people know this, but we are the second-largest broadcast group with pay-TV networks in all [of Europe] and free-TV networks in nine European markets. Our offer to consumers includes 50 linear brands. We have HBO Max in the Nordics, the Netherlands, Spain, Portugal and Central and Eastern Europe, and discovery+ in the U.K., Italy, Germany, the Nordics and a few other European markets. We are number one in Poland with the TVN Group and number two in Norway and Italy. We are number three in Germany, Spain, Sweden, Finland and Denmark and number five in the U.K.

When we talk about Europe, we also need to talk about sports. Eurosport is the number one pan-regional sports destination in Europe. We are the home of the Olympics, the home in most of the markets of the Tour de France, of most of the cycling tours, and we are the home of golf.

And finally, when you think of Europe, you also must acknowledge that it’s the region that delivers the most revenue when it comes to monetizing the U.S. content we produce, whether it’s theatrical or home entertainment, content sales, games or consumer products.

WS: You mentioned channels, and I was going to ask how relevant they still are. But is it even fair to call them channels? Haven’t they transformed into destinations or brands that people can watch in different ways?

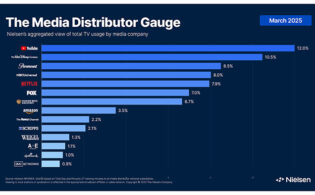

ZEILER: You are absolutely right. But let me say one thing: Linear TV is not dead. We believe in linear. Yes, we have to be honest—all the statistics show that the number of minutes watched on streaming is increasing. But still, the majority of minutes watched is on linear, in the U.S. and even more so outside the U.S. For us, this means we are required—and happy to do so—to give the consumer both options, streaming and linear. When it comes to linear, it’s pay-TV networks and free-to-air networks. I strongly believe that linear networks will continue to be a factor in the future of video consumption. And it’s also a strong provider of revenues and cash flow. And let’s not forget that we own strong free-to-air networks. That helps us a lot in promoting our streaming services.

WS: Is sports the one genre that has to be watched live as it happens?

ZEILER: Absolutely. Sports is a strong asset for Warner Bros. Discovery. Through our sports businesses, whether channels, platforms or brands, we collectively reach roughly 130 million people outside the U.S. every month. And we are based in more than 200 markets and 20 languages. This includes Latin America, as I mentioned, Eurosport; GCN, the Global Cycling Network; GMBN, the Global Mountain Bike Network; and our golf offerings, GOLFTV and Golf Digest. And let’s not forget, you can also watch a lot of sports on HBO Max in Latin America, on discovery+ and on our free-to-air networks in Europe. And one thing is for sure: sports programming is booming. If you compare the ratings of linear networks before and after the pandemic, the big winners are sports and news. And we have both.

WS: How do you decide to launch HBO Max or discovery+ or the upcoming joint service in a country? What factors do you consider?

ZEILER: First of all, David Zaslav [the president and CEO of Warner Bros. Discovery] and JB Perrette [the CEO and president of global streaming and interactive] made it clear during the Q2 presentation in August that our streaming strategy has evolved as the market has evolved. Yes, streaming is an essential part of our strategy going forward, but it’s not our only strategy. It was also announced that the new combined streaming service will be launched sequentially, starting next summer in the U.S., then in the second half of the year in Latin America, followed in the European markets in the first quarter of 2024 and some key Asia-Pacific markets and some Western European markets in the second half of 2024. It’s too early to make predictions going further, but what is important is that we will look at every single market individually. We will make the best decision on how to tackle streaming, whether it makes sense to go alone or with a partner or postpone the launch. And David Zaslav made it very clear that subscriber numbers are not the only factor in how success is measured. It’s important, but not the only important [metric].

WS: Is it still part of Warner Bros. Discovery’s strategy to sell movies and TV programming to third parties?

ZEILER: We are the owners of probably the largest global library of content. This, I would say, requires us to maximize the value through a broad distribution and monetization strategy. It makes sense to monetize across all windows, from theatrical to home entertainment, streaming and linear. It’s also clear that when we want to be the home of the best and greatest storytellers, we can’t create and use content only for our networks. Yes, a lot of the content we create we make for and use on our platforms. But there are also shows that are created for and air on third-party platforms that are very successful: Ted Lasso on Apple TV+, Abbott Elementary for ABC and The Sandman on Netflix. And we will not give up this third-party business. It wouldn’t make sense financially, and I also don’t believe that we could hold on to the best storytellers in the world if we tell them they could work only for our networks.

WS: How important is children’s content to Warner Bros. Discovery’s international services?

ZEILER: Kids’ networks for our company and especially internationally are important. In Latin America, Cartoon Network and Discovery Kids are two of the top three pay-TV networks. In Europe, we not only offer Cartoon Network and Boomerang in all the pay-TV markets, but we also have quite a few free-to-air brands: Boing, together with Mediaset in Italy and Spain, K2 and Frisbee in Italy. In Asia, Cartoon Network is in every country. In India, we have three kids’ networks—Cartoon Network, Pogo and Discovery Kids—the number one kids’ portfolio in July. The kids’ business is important for us, and [the significance of these businesses] will not decrease going forward.

WS: From an international perspective, what is your view of movie production and distribution? Movies are still important, aren’t they?

ZEILER: Movies are important. Let’s not forget that the history of our industry is the history of windowing content on different platforms. Only Netflix believes that putting content on only one platform is good for the consumer and a good business model. We don’t believe in this. David Zaslav made it very clear: We believe in the theatrical window as it elevates the interest and demand for films. We see that slowly people are coming back to theaters. Look at The Batman or No Time To Die or Spider-Man: No Way Home. The box office of these films was huge, much more than most people would have thought. But the smaller films, the “nice to haves,” still struggle. We will see how this goes moving forward. It also means that our local feature film strategy is important. We have been operating for more than ten years in Germany, Japan, France, Spain, Italy and the U.K. in releasing local feature films. That is an essential part of our theatrical strategy.

WS: You’ve been a proponent of local programming for a long time. Local content is not just scripted. Unscripted local is also essential, isn’t it?

ZEILER: Local content is essential for all platforms, whether streaming or linear. We’ve always had success as a company with our local content. On the scripted side, 30 Coins, a Spanish HBO production, was even successful in the U.S., as was Beforeigners, a mystery sci-fi series that came out of the Nordics.

But local content doesn’t mean only scripted drama or scripted comedy. There are a lot of unscripted formats, documentaries and specials in factual, lifestyle and reality that are successful. The most successful shows in many discovery+ markets are local versions of 90 Day Fiancé. Two examples of successful crime documentaries on HBO Max: Dolores: The Truth About the Wanninkhof Case, which we released last October, was one of the programs with the highest engagement numbers in Spain. Recently, a crime documentary in Brazil on HBO Max, Pacto Brutal: O Assassinato de Daniella Perez [A Brutal Pact: The Murder of Daniella Perez], five episodes about the murder of a soap star in Brazil in the 1990s, had the highest acquisition and engagement numbers of any local productions in Latin America. You can see that it doesn’t matter if relevant stories are scripted or unscripted. If they are relevant, they find their audience.

WS: In your previous position, you oversaw global advertising. What are advertisers’ major concerns today, and what does Warner Bros. Discovery offer them?

ZEILER: Advertisers and brands want three things: First, the best reach they can get. Second, the best targeting they can get. And third, an environment that is fit for their messages. The good news is that we have the ability with our assets to offer all of it. We have the reach through our linear networks and the targeting through our streaming platforms, which include, in more and more markets, an advertising solution. And the genres we offer with our networks are so broad that I don’t see a lot of advertisers who won’t find the right environment for their messages. We are in a good place when it comes to advertising, whether in the U.S. or outside the U.S.

WS: Given everything going on in the world, the war in Ukraine and inflation, are you more optimistic than concerned about the possible impact on consumer spending?

ZEILER: The war in Ukraine and the global supply chain crisis have an impact on the global economy. A lot of people are asking whether a recession is coming or not. And I would lie if I replied that a recession wouldn’t have a negative impact on consumer spending.

But let’s not forget that we know from the last financial crisis that when people have to make tough choices about where and how they spend their money, they also tend to spend more days at home watching TV. This will not compensate for everything, but it’s a good factor for our industry. And the [most recent] U.S. data is positive. I’m more optimistic than pessimistic.