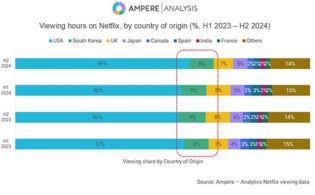

After several years of holding back titles for their own streaming services, the Hollywood studios are heading into a “licensing renaissance,” with Disney out front in terms of having a slate of licensable content, owning more than double that of its rivals, according to Ampere Analysis.

The research firm created a licensing power ranking, looking at titles that have been held back on studios’ streaming services and determining their “licensing power” based on whether they have completed a first run, have at least three seasons, are scripted and of U.S. origin and have consumer engagement as measured by Ampere’s “Popularity Score.” Disney owns 148 with licensing power that were still exclusive to its own streaming services as of December 2023. Paramount Global is second with 72, followed by Warner Bros. Discovery (54) and NBCUniversal (47).

The number of TV seasons cross-licensed between Netflix and Warner Bros. Discovery’s Max and discovery+ more than tripled last year. In addition, Amazon’s overlap with studios’ streaming services also grew significantly, Ampere says.

Comedy accounts for about 25 percent of titles with licensing power across the four major studios. “The enduring nature of these assets is a desirable characteristic for streamers,” Ampere reports. “Their sheer volume can keep audiences engaged for longer, making them a valuable subscriber retention tool. This is particularly the case as churning and re-subscribing to subscription services is becoming an increasingly common behavior. They are also effective in generating ad revenue.”

Ampere also notes that not all identified titles with licensing power will necessarily be cross-licensed. Studios are less likely to give up exclusivity on franchises, with Ampere highlighting that six of the 20 most popular titles in Paramount Global’s vault are in the Star Trek franchise. However, Ampere adds, Warner Bros. Discovery’s 2023 deals to license recently released DC content to Prime Video, Netflix and Tubi reflect a changing approach to exclusivity around key IP.

Choosing the right licensing partner is key, namely a service with a large user base and the smallest audience overlap. Per Ampere, 44 percent of viewers who did not watch Disney+ in the previous month did watch Netflix, followed by Amazon and Hulu. These three platforms also top the list among viewers who did not watch other major streamers, including discovery+, Max, Paramount+ and Peacock. Next on the list of viewers who did not watch Disney+ in the past month are AVOD services Tubi and Pluto TV.

Ampere also highlights that cross-licensing with AVOD platforms is more likely to skew towards unscripted content. Unscripted titles licensed to AVOD services are also more likely to be non-exclusive.

Rahul Patel, research manager at Ampere Analysis, noted: “We expect more licensing deals for high-profile titles to be struck in 2024 between major VOD providers. Studios’ strategies will need to carefully balance exclusivity and non-exclusivity to ensure their streaming offerings are distinct and compelling while also maximizing the value of their content as it moves to a second window. Licensing can expand the audience for existing assets, extend shelf life and at the more successful end of the scale, inspire franchise expansion. This was the case with NBCUniversal when it commissioned a Suits spin-off following its success on Netflix. Such an approach is particularly beneficial in the current climate when commissioners are being increasingly cautious with their content spend.”