Total viewership on premium VOD platforms in Southeast Asia rose by 7 percent in 2024 to 440 billion minutes, with revenues rising by 14 percent and subs by 12 percent, according to Media Partners Asia (MPA).

Leveraging its ampd VOD measurement platform, MPA found that premium VOD revenues rose to $1.8 billion, with subs reaching 53.6 million in five markets in Southeast Asia.

The premium VOD increases were led by Indonesia, the Philippines and Malaysia, offsetting a slight slowdown in Thailand, MPA says. Indonesia remains the biggest market at revenues of $552 million, ahead of Thailand at $473 million.

“Southeast Asia’s streaming landscape is evolving rapidly,” said Vivek Couto, executive director of MPA. “While Netflix has solidified its leadership position, the category is growing with the entry of Max and the scaling of local and regional platforms like Vidio, Viu and TrueID. The next phase of growth will be fueled by the expansion of connected TV (CTV) and home broadband penetration. Continued investment in local/Asian content and premium sports, led by Netflix and key local and regional platforms in Indonesia, Thailand, and Malaysia, will further stimulate growth. The industry is also exploring new strategies focused on short-form content and bundling partnerships to attract and retain subscribers.”

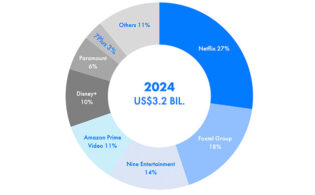

Q4 saw significant gains, with 3.2 million net new additions. Netflix captured 48 percent of those, driven by its local content slate as well as Korean and U.S. fare. Netflix has about 12 million customers in Southeast Asia, with a 52 percent viewership share and 42 percent revenue share. Max arrived in Southeast Asia in November and landed 26 percent of the quarter’s SVOD gains, led by a strong launch in Thailand. MPA estimates Max has about 1.4 million customers in the region. Disney+ has a 10 percent share of premium VOD revenues in the region. Local players are seeing gains, with Vidio leading the Indonesian market with 4.7 million subs and regional powerhouse Viu ending the year with 9.5 million customers.

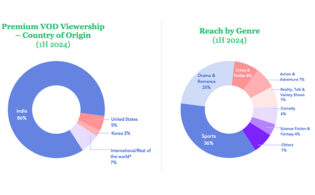

In terms of content trends, MPA points to continued popularity of Korean series across SVOD and freemium/AVOD, with a 28 percent share of all premium VOD viewing. U.S. content landed a 20 percent share of viewership, driven by SVOD. Southeast Asian and Chinese content are on the rise in Southeast Asia, especially on freemium/AVOD services, and anime continues to perform well, particularly on SVOD platforms in Thailand.