AI, the importance of bundling and the value of known IP in maintaining the strength of the streaming landscape are key takeaways from analytics firm Samba TV’s latest The State of Viewership report tracking consumption trends in the first half of this year.

Analyzing some 45 billion hours of linear and streaming television consumption, Samba TV highlighted the role that advanced AI measurement tools—including logo recognition, tailored release schedules and bundles—will play in driving viewer engagement and bolstering ad opportunities in AVOD and FAST. This is particularly important for the political ad cycle that is heating up this year with the U.S. presidential campaign. Non-political advertisers should also expect an increase in CPM rates.

“The AI hype cycle has passed, but AI transformation has just begun,” said Ashwin Navin, co-founder and CEO of Samba TV. “In this evolving landscape, and on the brink of a transformative election season, now it is more important than ever to employ a cross-channel strategy for audience outreach and measurement. Streaming video providers are innovating to retain viewers, fighting tooth and nail for engagement and collectively eroding the base of linear. The advertising market focused on linear and CTV formats is seeing stability, particularly in the pharmaceutical and health sectors, but we are seeing declines from the entertainment vertical, as some ads shift to social and digital.”

Linear continues to decline as streaming surges, Samba TV notes. In the first six months of this year, American homes watched a record level of OTT content, reflecting a 40 percent gain from 2023. The report found that 99 million U.S. households streamed content online in the first half. Linear TV hours viewed declined by 1 percent as more live events moved online and cord-cutting continued. The average daily reach of linear fell by 2 percent year-over-year.

Samba TV also points to the increasing importance of FAST and AVOD tiers on subscription services for marketers moving away from broadcast and cable. Per Samba, some 33 percent of U.S. audiences are using FAST services. “This shift toward ad-supported streaming offers advertisers ample opportunities to engage with younger audiences and adapt to the evolving media consumption landscape,” Samba TV says.

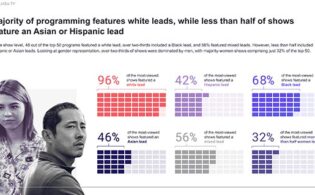

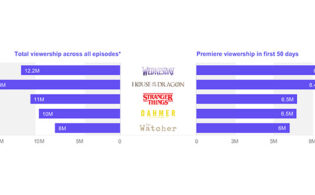

Sports, politics and franchise-based streaming originals were among the drivers of viewing. The Super Bowl hit viewership records for streaming and broadcast. “However, with many sporting events moving to streaming platforms, linear will struggle to maintain viewers,” Samba TV says. The Donald Trump and Joe Biden presidential debate was the most-watched non-sports program of the first half. In terms of other content, drama leads streaming consumption, accounting for 68 percent of the top 50 shows, led by crime and mystery. Of note, all of the top ten most-streamed shows were based on known IP, including Netflix’s Fool Me Once and Max’s House of the Dragon. “The dominance of original content in the streaming landscape showcases the power of leveraging existing IP to engage audiences and drive streaming success,” the report notes.

Of course, amid a crowded environment and cost-of-living concerns, churn is a challenge for SVOD operators. Samba found that 44 percent of homes watched just one or two services in the first half. In Q1, the number of gross additions was 55.2 million, while cancellations hit 50.4 million. Platforms often lose viewers after one original—Netflix being the exception, with just 30 percent tuning in for just one show, as compared with Paramount+, where 71 percent tuned in just for Halo. “With churn presenting real challenges for streamers, they must find ways to ensure audiences are engaging with their broader content library and see the value of their subscriptions beyond one new program.”

What brings subs back? A buzzy new show, Samba TV says. These included Ted for Peacock, Halo for Paramount+, Masters of the Air for Apple TV+ and Shōgun for Hulu. Bundling also helps limit churn, Samba TV notes.

As release strategies shift, consumers are still opting to binge, particularly with docuseries and crime shows and less so with comedies and dramas. “When flighting release schedules, streamers should bear this in mind and give thrill-seeking docuseries viewers the opportunity to gobble up content quickly, while spacing out plot-driven comedies and dramas.”