Speaking at ATF Online+, Priya Dogra, the president for EMEA and Asia (excluding China) at WarnerMedia, discussed the company’s recent reorganization, managing through the COVID-19 pandemic and her priorities for 2021.

Dogra was interviewed by Vivek Couto, executive director of Media Partners Asia, for the session, which was part of ATF Online+’s series of conversations with industry leaders.

WarnerMedia, under new CEO Jason Kilar, unveiled a revamped structure earlier this year, creating an international unit—led by Gerhard Zeiler—to house all of the company’s activities, from content distribution to networks to theatrical. “We have historically operated as individual companies,” said Dogra. “That was the right strategy for the time. As things change and the consumer journey changes, what makes sense now is for us to approach the market on a more cohesive basis. By bringing these activities under one leader, we’re hoping to have a little bit more of an integrated approach on the ground.”

For Dogra, that means oversight of what used to be branded as the Turner channels in EMEA and Asia, as well as the HBO and Warner Bros. businesses. “That includes the linear networks, theatrical distribution, local marketing activities for U.S. product, local theatrical production, local content production, home entertainment, affiliate distribution. It’s a fairly large set of activities in each of these regions.”

By combining all of those operations, “we would be able to manage the audience journey right through different means of distribution, different means of exploitation, but also have one person in each of the regions that our partners could go to,” Dogra said. “It provides simplicity.”

Asked about the impact of COVID-19, Dogra noted that the pandemic has accelerated the structural changes the company was already facing. “We were starting to see an erosion of the pay-TV ecosystem, particularly in the U.S.—that has accelerated as a result of the pandemic. We were seeing a shift of advertising from traditional TV to digital. Again, acceleration. The theatrical experience has been incredibly important but you were seeing this flight to more tentpole titles and the rest being viewed more over streaming. In every category you look at, we were seeing the trends and they’ve all been accelerated by COVID.”

The pandemic has posed an “incredible management challenge for every media company,” Dogra continued. “You don’t know how long it’s going to last. You don’t know what consumers will want to do when life returns to some semblance of normalcy. Across the world, the global box office is down something like 65 percent. Pay-TV subscribers, depending on the territory, are down double digits. We’ve seen those impacts in our business. The outlook in March was probably more dire than the outlook today, from a business perspective. There’s been a lot of innovation. The way we’ve approached advertising partners is different. We’ve seen a bit of recovery in the ad market in general. We’ve seen a lot of innovation in how we put movies out—a combination of theaters and streaming or transactional. So we’ve found ways to mitigate the impact of the pandemic. But make no mistake, this is a huge shift and a huge impact in terms of the profitability of our industry. What’s not clear is what [sectors] recover.”

Dogra said that one of her key priorities going forward is ensuring that the new regional structure implemented by the company works. “I strongly believe we can create value for ourselves, our audiences and our partners by having that integrated approach. My priority is to ensure the model works. We’re trying something that is different. The vision is to show that this structure creates value.

“Every time you bring businesses together, there’s the question of the human impact,” Dogra continued. “Making those difficult choices, having some of our colleagues leave and then motivating the people who remain and driving them to create the kinds of experiences we want to create for consumers—doing that successfully is the challenge we have in front of us. Part of it is, how do you take these organizations and create the right culture? What I can do is set the attributes of that culture. The culture is defined by the ways you promote people, recruit people, develop people, hire people. Focusing on that, and making that a success, is really part of where I’m going to be spending my time over the next few months.”

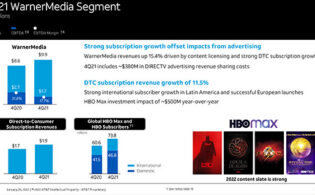

On the overall strategy for streaming at WarnerMedia, Dogra noted, “There is a lot that [our] brands can do for us, and they become an organizing principal for how consumers interact with us. HBO is an incredible brand, it means something to consumers, it hits a certain audience. We have this wealth of content produced by Warner Bros. that we know works because we license it all over the world. As consumers leave the pay-TV ecosystem, which they are doing, then we have fewer ways for them to view our content, practically speaking. So you start to take the HBO content and complement it with the things that used to be on pay TV or broadcast TV and you say, here’s a product that, as consumers leave the pay-TV ecosystem, we can catch them. That’s how we think about streaming.”

The international strategy for HBO Max is in the works, Dogra continued. “Our strategy is to think about how much investment we put into that, where we launch, and what those plans look like. But the premise is fairly simple. We have the content, we have the connection with the audiences, we have to create the platform and the distribution means to go after it.”

In Southeast Asia, HBO GO is the company’s streaming product. It currently delivers the HBO library of U.S. content, HBO Asia originals, HBO Max shows and more than 1,000 hours of kids’ content—“which we will double,” Dogra said—and “more first-run U.S. movies than any other streamer in the region.” It is available on an authenticated basis for linear subs, and on a D2C basis. “We’ve also worked with our distribution partners in the region,” Dogra added. “It’s an incredibly mutually beneficial relationship. It allows them to give something of value to their consumers and allows us to leverage their infrastructure and distribution and it creates stickier and happier customers. It’s been an incredible year for HBO GO. The team has signed eight distribution deals across the region. We nearly doubled the number of subscribers. We will continue to invest in HBO GO and drive distribution for it. As the plans for HBO Max get developed, particularly for Asia, then that product will transition.”

In Japan, the company’s content production capabilities will provide “a lot of optionality in the future,” Dogra said. “As we think about launching Max, that gives us a great base to start with.”

In India, which has been a strong market for WarnerMedia’s kids’ networks, less so for the English-language general-entertainment channels, “we’re not where we would like to be, from a direct distribution perspective,” Dogra said. “Those are the things we’re evaluating now. With streaming, changing the means of distribution gives you optionality that we didn’t have before, where channel launches were the only way to get the distribution. We’re in the process of making those plans now.”

For 2021, Dogra is focused on making the integration successful, being nimble in decision-making and “continuing to grow and maintain market share through this new structure.” Investing in local content is a key part of that strategy, she said. “And then maintaining and growing our existing direct-to-consumer business while making plans for HBO Max in the region.”