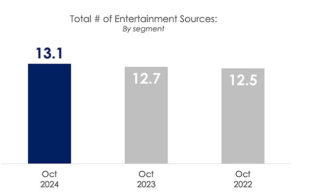

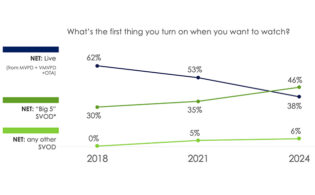

Hub Entertainment Research has released a new study that shows streaming providers could face “congestion” as the proliferation of video services has given viewers a logistical problem of deciding what to watch amid a “vast sea of options.”

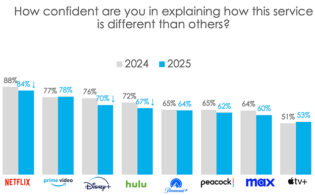

Hub says that streaming marketers have done a good job of driving awareness, as even the newest platforms have brand awareness of more than 90 percent. Value propositions, however, are another story, as far fewer consumers feel confident they know what makes one SVOD brand different from the others.

For Netflix, 98 percent had heard of it, but only 79 percent could explain to someone what differentiates it. For Prime Video, that was 97 percent vs. 69 percent; Disney+ 96 percent vs. 67 percent; HBO Max 96 percent vs. 63 percent; Hulu 96 percent vs. 62 percent; Paramount+ 93 percent vs. 50 percent; Apple TV+ 93 percent vs. 46 percent; and discovery+ 93 percent vs. 41 percent.

In January 2023, 41 percent of respondents said in the past year they had signed up for a new streaming service just to watch one show (up from 35 percent in 2021), while 57 percent of those under age 35 have signed up to watch one show, and among households with kids, it’s 54 percent.

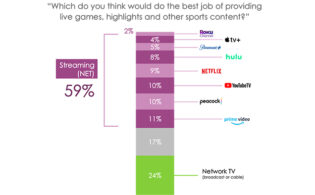

The most common reason cited for dropping a streaming platform is that consumers “ran out of things to watch.” Hub points out that in 2023, providers must do more with less and leveraging the brands of key IP is a powerful way to do just that. For example: in January 2023, 29 percent of respondents said they had watched Yellowstone. Of those, 70 percent said they had gone on to watch one or more of the shows related to Yellowstone (direct spin-offs or shows promoted as coming from Taylor Sheridan/the creators of Yellowstone). Yellowstone, though, can only be watched on cable or Peacock, while those other shows require a subscription to Paramount+.

“Content has always been king,” said Jon Giegengack, principal and Hub founder. “But as the streaming ecosystem gets more crowded, the role of IP branding on which platforms viewers sign up for and keep is more direct than ever. And at a time when mitigating churn has become job one for providers, valuable IP will be more valuable than ever.”