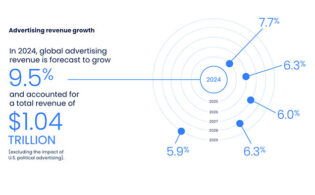

GroupM’s This Year Next Year Mid-Year 2023 Forecast projects global advertising in 2023 to total $874.5 billion, excluding U.S. political advertising, rising 5.9 percent.

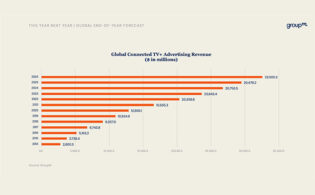

A particular bright spot, according to the report, is that connected TV adoption, among consumers and advertisers, is growing rapidly, adding 10.4 percent in ad revenue between 2023 and 2028 on a compound annual basis. Consumer spending on SVOD represents between just one-fifth and one-third of total video spending in major markets, leaving plenty of room for streaming providers to grow subscriptions.

In 2023, global traditional TV revenue is forecast to be $133.6 billion (excluding U.S. political advertising). By comparison, CTV revenue in 2023 is estimated at $25.9 billion, an increase of 13.2 percent over 2022.

Digital pureplay ad revenue will account for 68.8 percent of the total in 2023 and will reach 74.4 percent of total ad revenue by 2028. A single-digit growth should be thought of more as a function of the size and maturity of “digital” rather than a recessionary environment.

The U.S. is expected to lead the market, generating $322.5 billion in ad revenue in 2023, at 5.1 percent growth. China, in second, will deliver $150.6 billion, at 7.9 percent growth. In third, Japan is projected to garner $52.6 billion, at 4.8 percent growth.

The U.K. is expected to deliver $49.4 billion, 4.8 percent growth in 2023. Germany follows with $36.1 billion, 6 percent growth; France with $26.9 billion, 4.2 percent growth; Canada with $19.7 billion, 5 percent growth; Brazil with $19.2 billion, 6.6 percent growth; India with $17.3 billion, 12 percent growth; and Australia with $14 billion, 0.2 percent growth.

“We are at an inflection point where the secular drivers of advertising growth above and beyond GDP growth are maturing, the pandemic upheaval is receding, and the dynamic rise of digital advertising has slowed,” said GroupM. “This is the basis of our underlying forecast of mid-single-digit advertising growth over the next five years.

“However, the pervasive impact of AI on the world of advertising could change that. Advertisers in this environment will be well-served by having proactive guidelines and the right partners to navigate these waters so that choices in budget allocation and the use of AI are made intentionally with the long-term health of the business in mind.”