The Walt Disney Company has pulled a slate of networks, including ESPN, Disney Channel and FX, off Charter Communications’ Spectrum service.

The U.S. pay-TV and broadband provider says the carriage spat impacts ESPN, ESPN2, ESPN Deportes, ESPNU, ESPN News, SEC Network, ACC Network, Longhorn Network, FX, FX Movie Channel, FXX, Freeform, National Geographic, Nat Geo Wild, Nat Geo Mundo, Disney Channel, Disney Junior, Disney XD and BabyTV, as well as ABC on-demand programming and several local ABC stations in key metros such as Chicago, Los Angeles, New York and San Francisco.

Charter says it “offered Disney a fair deal, yet they are demanding an excessive increase. They also want to limit our ability to provide greater customer choice in programming packages, forcing you to take and pay for channels you may not want.”

In a webcast for investors this morning, Charter’s leadership called for a new approach towards carriage deals, saying it is seeking to move towards a “customer-centric business model.”

Charter noted: “We respect the quality video products that The Walt Disney Company produces as well as the experience of its management team. But the current video ecosystem is broken, and we know there is a better path that will deliver video products with the choice consumers want.”

Charter says it seeks to work with Disney to “lead the way” in changing the business model, “which is why we are disappointed that thus far they have insisted on unsustainable price hikes and forcing customers to take their products, even when they don’t want or can’t afford them. They also want to require customers to pay twice to get content apps with the linear video they have already paid for. This is not a typical carriage dispute. It is significant for Charter, and we think it is even more significant for programmers and the broader video ecosystem.”

The model that Charter says it has proposed to Disney “could both stabilize linear video and create a clear growth path for direct-to-consumer video, with a more customer-friendly and financially attractive end-state for programmers.”

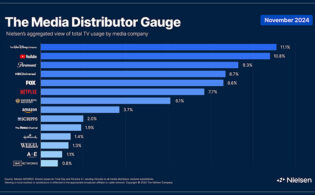

Charter referenced the losses at pay-TV providers as consumers and content have moved to SVOD services, noting that traditional virtual MVPDs have lost almost 25 million customers in five years. “Over the past four years, The Walt Disney Company’s cable portfolio has seen significant viewership declines—across sports, general entertainment, and most dramatically in children’s programming, where they have created a DTC substitute for children’s content: Disney+.”

Charter maintains that despite this, Disney is still seeking higher license fees and less packaging flexibility. “We believe that renewing a traditional distribution deal in line with The Walt Disney Company’s current offer would ignore the realities of today’s video business and accelerate its decline. We do not take this decision lightly. For 2023, we had expected to pay The Walt Disney Company more than $2.2 billion for just the right to carry that content, not including the impact of advertising on either party. But we have reached a precipice and must chart a path to change.”

Charter says it would accept Disney’s “market rates” in exchange for lower penetration minimums and the ability to include its ad-supported DTC apps within its packaged linear products and market the DTC products to its broadband-only customers. This model, Charter asserts, would be better for consumers and would support Disney in its DTC transition, “including the ability to stem linear subscription and advertising revenue losses, reduce DTC churn, increase advertising revenue and likely drive more upgrades within their digital television apps. Ultimately, it provides a more sustainable revenue stream, in our view.”

The benefits for Charter include the ability to increase its linear video relationships, retain price-sensitive customers and sell DTC subs to broadband-only customers.

“We think the opportunity for customers and all of us as market participants is too big, too important, and too timely to pass up. The Walt Disney Company and Charter have the opportunity to work together on transforming the industry for the long-term benefit of both companies and their customers. Without them, we need to pivot to other models to drive value for our connectivity relationships. We are either moving forward together with a collaborative business model, or we’re moving on.”