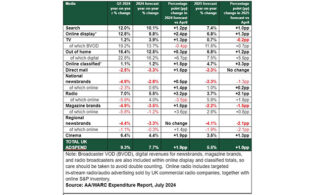

The latest data from the AA/WARC Expenditure Report shows a stable first quarter for the U.K. advertising industry, with spend rising 0.1 percent year-on-year to reach £9 billion.

The outlook for the total U.K. advertising market in 2023 suggests that while growth will be minimal at 2.6 percent year-on-year, the outlook has improved (up 2.1 percentage points) since the previous forecast in April. Spend is now expected to reach £35.7 billion.

This reflects a return to growth of key online formats, with internet now forecast to account for 76.7 percent of all spend this year and 77.6 percent next year, compared to 75.1 percent in 2022.

TV, meanwhile, is down 7.2 percent in Q1 and is projected for a 1.4 percent decrease year-on-year. The forecast for 2024 is 2 percent growth, revised upward 0.4 percent points from the previous April projection. Broadcaster video-on-demand (BVOD) spend, though, rose 18.7 percent during the first quarter and is set to continue posting gains over the forecast period. It is looking at a projected 17.3 percent growth for 2023 and 10.1 percent for 2024.

The U.K.’s ad market overall is forecast to grow by a further 4 percent in 2024, to a value of £37.1 billion, a slight downgrade (1.3 percentage points) from AA/WARC’s April forecast but equates to 1.1 percent growth in real terms.

Stephen Woodford, CEO of Advertising Association, commented: “This latest forecast indicates a slight improvement in outlook in terms of growth of spend, with the improvements in online forecasts being notable. However, with high inflation continuing to depress consumer and business confidence, we may end up seeing a real-terms contraction of nearly 4.3 percent in 2023 for U.K. advertising investment. The recent higher-than-expected fall in inflation will hopefully continue, and with that, we will see confidence begin to build later in the year and into 2024 when the ad market is expected to return to growth.

“It is vital to recognize the value that advertising brings to the economy in supporting competition, innovation and growth ahead of the general election next year. Together with WARC, we will continue to monitor advertising expenditure results and provide guidance for our industry and policy decision-makers within the U.K. government.”

James McDonald, director of data, intelligence and forecasting at WARC, commented: “With the economy flat over the last three years, and inflation remaining stubbornly high, macroeconomic headwinds continue to bear down on the U.K.’s advertising industry. That said, a welcome return to growth in key online sectors during the first quarter has been cause for an upgrade to our full-year projections, with a forecast rise of 2.6 percent demonstrative of more favorable trading conditions in the second half of the year.”