According to Zenith’s latest Advertising Expenditure Forecasts report, global advertising expenditure is poised to grow 8 percent in 2022.

This figure represents a slight downgrade from the 9.1 percent growth rate Zenith published in December 2021.

Growth will be supported by the Winter Olympics, mid-term U.S. elections and World Cup soccer, which for the first time will take place in the most advertising-intensive period of the year in the run-up to Christmas.

Faced with this tough comparison, growth will slow to 5.4 percent in 2023, before the Summer Olympics and U.S. presidential elections help boost it to 7.6 percent in 2024, Zenith forecasts.

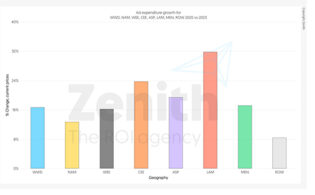

The forecasts for North America, MENA and Western Europe this year are unchanged at 12 percent, 7 percent and 6 percent growth, respectively. Latin America was downgraded slightly from 9 percent to 8 percent. The Asia Pacific was upgraded from 6 percent to 7 percent, thanks to a very strong performance from India. Severe disruption in Russia and its closest trading partners after the invasion of Ukraine will lead to a 26 percent decline in adspend in Central and Eastern Europe, even though most other markets in the region will continue to grow.

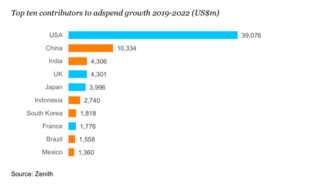

Global adspend is forecast to increase by $58 billion in 2022, rising to $781 billion from $723 billion in 2021.

Most of the new ad dollars will come from the U.S., which is

forecast to expand by $33 billion in 2022, driven by continued, rapid digital transformation, accounting for 57 percent of all the money added to the ad market this year. China, Japan and the U.K. follow, supplying 9.1 percent, 6.2 percent and 5.8 percent of new ad dollars, respectively. India is in fifth place, accounting for 4.6 percent of the growth in adspend this year, even though it is only the 12th-largest ad market. India will be the fastest-growing market in percentage terms, expanding by 20.8 percent, driven by election advertising and the resumption of festivals that were canceled at the height of the pandemic.

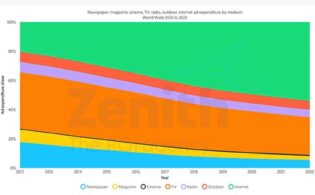

Online video is now forecast to be the fastest-growing channel over the next three years: Zenith predicts it will grow 15.4 percent a year on average between 2021 and 2024. Zenith expects online video adspend to rise from $62 billion in 2021 to $95 billion in 2024. Online video will overtake social media, the fastest-growing channel for the previous nine years.

Linear TV advertising is forecast to grow by 1.1 percent a year on average between 2021 and 2024, from $173.6 billion to $179.2 billion, as price rises continue to compensate for loss of audiences. Television’s share of total adspend is forecast to fall from 24.6 percent in 2021 to 20.8 percent in 2024, while online video’s share increases from 8.8 percent to 11.1 percent.

“Online video is growing by creating new opportunities for building brand awareness, complemented by social media’s capacity for cost-effective targeting with low barriers to entry,” said Jonathan Barnard, head of forecasting at Zenith. “Online video is steadily narrowing the spending gap with television, and will be half as large as television by 2024.”