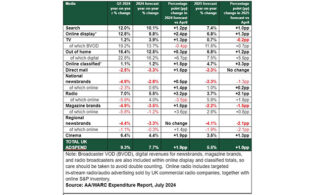

Global advertising revenues are projected to reach $1.07 trillion this year, a 10.5 percent gain, moderating to a 7.2 percent boost in 2025, driven in part by the connected TV market.

The 2024 forecast was revised upward by 2.3 percentage points, WARC said. North America leads gains with an 8.6 percent lift to $348 billion, helped by political advertising in the run-up to the November election. AsiaPac will bring in $272 billion, a 2 percent growth rate. Europe is on track for a 5 percent gain to $165 billion. Latin American adspend is projected to climb 6.2 percent to $32.1 billion. In the Middle East, WARC anticipates a 4.2 percent lift to $12.6 billion.

Looking ahead, WARC expects advertising spending to rise by 7.2 percent next year and then 7 percent in 2026 to reach $1.23 trillion.

This year, online-only companies will see a 14 percent rise in advertising revenue, reaching a total of $735.7 billion. Pure-play platforms are set to account for over 70 percent of all advertising spend worldwide next year.

James McDonald, director of data, intelligence and forecasting at WARC and author of the research, noted: “The global ad market has doubled in size over the last decade, with advertising investment growing almost three times faster than economic output since 2014. Three companies—Alphabet, Amazon and Meta—have been the largest beneficiaries from this period of expansion, attracting seven in ten incremental ad dollars over the last ten years. With retail media expected to lead ad spend growth over the coming years, and with new, diverse players emerging in ad selling—from Uber to Chase—we are once again seeing the value of first-party data in targeting the right person with the right message at the right time. Such data, combined with new AI enhancements, will constitute the fabric of the advertising industry for the next decade and beyond.”

Connected TV (CTV) is a key growth driver, with revenues projected to rise from $35.3 billion this year to $46.3 billion in 2026. CTV is set to account for two-thirds of all growth in the video market this year and all growth in 2025. By 2026, CTV will account for just under 24 percent of all video ad spend.

Legacy media—print publishing, broadcast radio, linear TV, cinema and out of home (OOH)—has a 25.3 percent share of adspend currently. Linear TV is expected to see a 1.9 percent lift this year, thanks to U.S. political spend.