M&A deal activity in the U.S. media sector fell 19 percent in the first half of this year compared to the second half of 2019, according to PwC, but digital and telco assets are still proving to be attractive assets amid the COVID-19 pandemic.

There were 259 deals in the first half of 2020, according to PwC’s mid-year deal insights for the media and telco sectors.

“While COVID-19 undeniably had an impact on the media and telecom sector, deal volumes had begun to contract in 2019, with the first half of 2020 broadly keeping pace with Q4 19 (albeit, with a weaker Q2),” PwC said. “While sub-sectors reliant on advertising revenues felt the impact more sharply, telecommunications and digitally focused sub-sectors were more resilient in the current environment.”

Deals involving private equity buyers accounted for 33 percent of deal activity in Q2 2020. “We expect to see private equity activity tick up in the second half of the year, as companies struggling through the current economy seek out capital infusions.”

PwC also found that 19 percent of deals involved international buyers acquiring U.S. assets. Asia Pacific countries made up the highest proportion of foreign buyers. Meanwhile, outbound deals with U.S. buyers and foreign investors declined from a peak of 59 in Q4 2019 to 31 and 32 deals in Q1 and Q2 2020, respectively.

Looking ahead, PwC said the outlook for the second half of the year is uncertain given the COVID-19 pandemic. “However, opportunistic acquisitions as valuations begin to decline, coupled with pending regulatory changes, pave the way for M&A to help companies on their path toward recovery.”

The “looming content shortage” will put pressure on media companies for the remainder of the year, PwC said. “With most start dates delayed, it’s inevitable that production delays will lead to delayed starts, longer production times to allow

for distancing measures or abbreviated seasons. This will have a knock-on impact to broadcasters who rely on content to generate advertising revenue, studios or production companies awaiting the availability of in-demand talent and streaming platforms which feature shows after their first run. In the short term, this will increase demand for non-scripted production with shorter lead times and the potential acquisition of content libraries to fill gaps.”

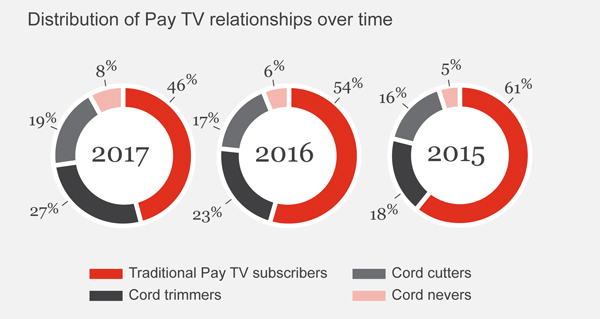

The industry should also brace for an acceleration of disruption in the pay-TV space, “with many households opting for multiple streamers at a lower total cost than their cable package.” PwC also sees potential in the virtual events space. “As interest in virtual experiences and technologies grows stronger in the current environment, media and tech companies will start to look at startups in the metaverse space as attractive M&A targets.”

TVUSA

TVUSA