Now available in 17 languages, the Indian entertainment platform ZEE5 is eyeing expansion beyond South Asian audiences, Archana Anand, chief business officer of ZEE5 Global, tells World Screen Newsflash.

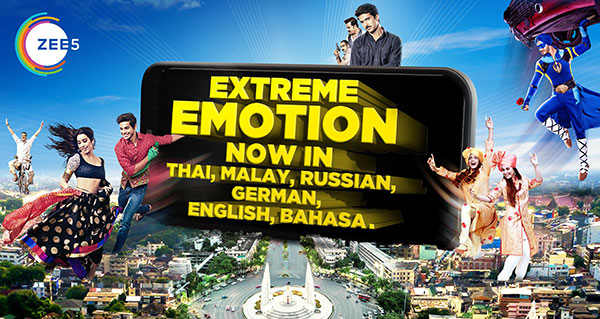

In April of this year, at the APOS Summit in Bali, ZEE5 announced the addition of five new language options: Malay, Thai, Bahasa, German and Russian. The platform, which delivers 100,000 hours of on-demand content and 60-plus live-TV channels, has been available in 190-plus markets since October 2018 in Hindi, English, Bengali, Malayalam, Tamil, Telugu, Kannada, Marathi, Oriya, Bhojpuri, Gujarati and Punjabi. The new language options reflect the platform’s ambitions to cater to much more than a South Asian audience.

Anand says ZEE5 has charted out a systematic growth strategy since its 2018 launch in India, where it replaced ZEE’s two digital platforms, the ad-based OZEE and the SVOD service dittoTV. Operating on a hybrid free and SVOD model, ZEE5 has been using the heft of the company’s deep library, as well as a string of high-end originals, to broaden its audience base, in India and abroad.

“The idea was to ensure that we attracted the millennial audiences, too, onto our platforms because on the linear side ZEE is more of a family channel,” Anand says. On linear, “there are limitations to how edgy our content can be, but on digital, we have the liberty to be a little more adventurous and are therefore catering to all ages and preferences. So we were quite clear that we would be much more experimental and create more fast-paced, cooler and edgier content that younger audiences have come to expect from a digital platform.”

ZEE5 has plans for 72 originals in the next year, short-form and long-form, across six local languages. The platform is also using high-profile Bollywood movies to drive usage, premiering many on ZEE5 first ahead of the linear window.

Following a strong local launch, the immediate priority for ZEE5 was AsiaPac, specifically the neighboring territories. “We galloped to the number one position in key markets like Bangladesh and Sri Lanka, which are the immediate affinity audiences for our content,” Anand says. “We got the sense that there is love for the content, so now let’s see if we can go further. Can we now cross over from the South Asian to the mainstream?”

The addition of Thai, Malay, Bahasa, Russian and German is a logical next step, Anand says, as those markets have already demonstrated an interest in Indian content. As it builds out its global presence, the company, like others taking the direct-to-consumer route, will be engaging in a delicate balancing act with its long-established channel and syndication businesses in the international market. For example, three of ZEE’s channels in the U.K.—&TV, Zing and Living Foodz—are now only available through ZEE5. The flagship ZEE TV and ZEE Cinema remain available through pay-TV partners.

“Linear is still a very important business for the company,” Anand says. “It is the bread and butter. Digital is the fledgling business, but it’s showing every sign of being a growth engine. The idea is not to pull out of linear. The idea is to make intelligent, specific calls [in individual markets]. Catering to a small percentage [of South Asians in a market] with niche channels, there is a transmission cost and a distribution cost. I’m not cutting off anything. I’m just moving you to another destination to get your entertainment from. It’s very tactical.”

It’s a similar story with the syndication business, Anand says. “Across the organization, we’re very clear that we’re putting our weight behind our digital platform.”

Key to ZEE5’s expansion will be telco partnerships, Anand states. “I don’t think any telco today is making money from voice or value-added services. Data has become the mainstay. There is no bigger, more powerful guzzler of data than video. So [telcos] partnering with us is natural for them. And we’re looking for distribution and marketing.”

Anand and her team are also making sure that ZEE5 is embedded in a wide range of devices, from the Roku player to the Amazon Fire Stick to Apple TVs. And she has an ambitious growth strategy for ZEE5 in an increasingly crowded Indian entertainment OTT space where competitors include Hotstar, Voot and Eros Now, all of which have either launched internationally or plan to.

A year from now, Anand says, “I want every South Asian outside of our country to be very clear that ZEE5 is their number one go-to destination for entertainment content from the subcontinent. As far as the mainstream audience is concerned, it would be fabulous if we were able to make our content go the distance and cross over. If there is a crossover of them understanding our formats and us understanding their formats, then the other only winner is great storytelling, which is what ultimately should drive the business.”

TVASIA

TVASIA