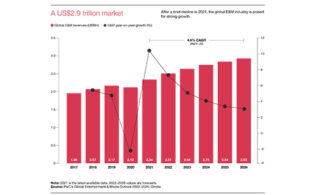

By 2026, the global media and entertainment (E&M) business will be worth almost $3 trillion, according to PwC’s latest Global Entertainment & Media Outlook, with the business steadily growing after 2020’s pandemic-induced contraction.

“The vast E&M complex is growing more rapidly than the global economy as a whole,” PwC reports. “With each passing year, more people around the world are spending more of their time, attention and money on the complex and increasingly immersive E&M experiences that are available to them.”

But those angling for a slice of that huge pie have plenty of “fault lines and fractures” to be aware of, PwC analysts caution. “The stable overall growth pattern masks an underlying volatility,” PwC says in its Outlook Perspectives Report. “It is clear that the pandemic accelerated changes in consumer behavior and digital adoption in ways that will affect future growth trajectories. Some of the sectors that saw immense gains amid the pandemic will not be able to sustain that growth, while others will continue to build from their higher bases. Some formerly niche sectors, such as gaming, will barrel their way into prominence, as other formerly dominant sectors will see their competitive positions erode.”

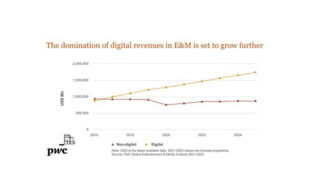

The global E&M business is expected to grow by 7.3 percent this year, PwC says, with a 4.6 percent compound annual growth rate (CAGR) through 2026. By then, the business, post-pandemic, will be “more digital, more mobile, more pitched at media that attract the young, more evenly distributed around the globe and more dependent on advertising in all its forms.”

Indeed, the ad market, projected to reach $1 trillion in 2026, will take a 35.1 percent share of global E&M revenues that year, inching above consumer spending (33.5 percent), as compared with 29 percent in 2017, well behind consumer spending’s 40 percent. “Why is advertising growing so rapidly? At root, the answer is simple: more consumers are spending more of their time in environments where they can be reached by digital ads and where they can conduct transactions in real time,” PwC says.

PwC also takes a deep dive into the streaming market, which was completely transformed by the pandemic. “Given the seemingly unlimited options arising around the world and the competition for the same limited pool of consumer dollars, something has to give.”

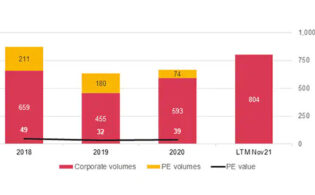

OTT video revenue growth is expected to slow to a CAGR of 7.6 percent through 2026, rising to $114.1 billion. “For the first time, players are confronting the prospect that there may not be enough individual subscriptions to feed their growth ambitions,” PwC observes. “The market tensions and declining share prices of many of the largest players, coupled with the potential for reduced investments on the part of private equity and venture capital, are likely to change the landscape. The assumption that throwing large sums of money at content creation to feed direct-to-consumer offerings will be enough to produce both massive growth and profit at scale is now in doubt. As a result, questions are arising as to what the next phase of growth will be.”

Amid ongoing competition with streaming services, traditional TV revenues will contract at 0.8 percent CAGR, falling to $222.1 billion in 2026.

PwC also has its eye on opportunities in the metaverse, citing a Citibank forecast that it represents an opportunity of between $8 trillion and $13 trillion through 2030. “The precise path of growth is uncertain. What is certain is that companies large and small, and even governments around the world, are investing to create new experiences.”

PwC concludes that this remains a golden age for consumers, who now have access to a “vast array of content, services and experiences at price points they can afford.”

For those serving those consumers, however, “intense competition and continual disruption remain the order of the day. That means strategy can’t remain static. The data clearly shows that the mix of revenues and spending is changing rapidly. And as the fault lines continue to proliferate and widen, it will be easy to end up on the wrong side of disruption. An understanding of the forces that are creating the fractures in our world should inform the creation of strategy. It has become clear that there is no easy solution to maintain a durable model for profitable growth in the coming years. The industry’s barriers to entry are too low, and the pace of innovation and change too high, for any one player to sustain competitive differentiation simply by operating as it has for the past five years. In sectors with sharply diverging growth paths in different countries, operating on a global basis now requires matching pricing models to purchasing power and saturation levels, often on a market-by-market basis. And, looking ahead, all participants who seek to thrive in 2026 will need an ‘and’ strategy that goes beyond their core: great content and multiple revenue streams and ties to broader commerce plays and compelling immersive experiences. The challenges are substantial—but so, too, are the rewards for those able to meet consumers where they will be.”