LONDON: Global advertising expenditure is expected to grow 4.4 percent this year to reach $539 billion, ahead of the 4.1 percent previously forecast, according to Zenith’s new Advertising Expenditure Forecast.

This upgrade is mainly due to stronger‐than‐expected growth in the U.S. Zenith expects U.S. network TV to return to growth this year (at 1 percent) after shrinking 5 percent last year, thanks to new spending by pharmaceutical and consumer packaged goods companies and a strong upfront. The firm also expects social media to accelerate from 32 percent growth last year to 35 percent growth this year, as advertisers take advantage of new formats, such as in‐feed video, and the transition to mobile internet consumption continues. Overall, U.S. ad spend is forecast to grow 4.4 percent this year, compared to our previous forecast of 3.8 percent.

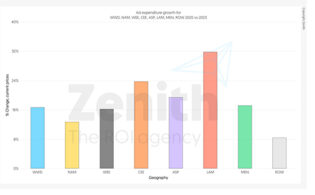

Zenith also made upgrades to its ad spend forecasts for the Asia Pacific and Western Europe. Asia Pacific is expected to grow 6.3 percent this year, up from the previous forecast of 6.2 percent, thanks to heavy political spending in the Philippines in the run‐up to the May 2016 elections. The forecast for Western Europe has also been upgraded, with improved conditions in Belgium, Finland, Germany, Italy, Norway, Portugal and Sweden compensating for slowdown in the U.K. The forecast is now for 3.6 percent growth in Western Europe this year, up from 3.5 percent in June.

The U.S. is set to be the leading contributor of new ad dollars to the global market between 2015 and 2018, beating China, which was forecast to lead in Zenith’s March and June forecasts, by $3.3 billion. Between 2015 and 2018, the global ad market is expected to grow by $73 billion. The U.S. will contribute 30 percent of this extra ad expenditure and China will contribute 26 percent, followed by Indonesia, which will contribute 6 percent, and the U.K., which will contribute 5 percent.

The vote for Brexit in the U.K.’s EU referendum has so far not seen any widespread budget reductions by advertisers. Zenith forecasts 5.4 percent growth in ad spend this year for the U.K., fractionally less than the 5.6 percent forecast just before the vote. The firm believes that most of the impact that Brexit will have on the U.K. ad market will come in the long term.

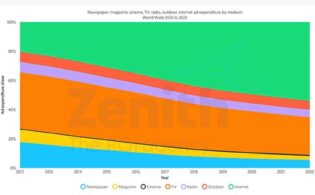

Television is currently the dominant advertising medium, attracting 37 percent of total spend in 2015. Zenith now expects the internet to overtake television to become the largest medium in 2017. Looking at the ad market as a whole, including search and classified, Zenith predicts television’s share peaked at 39.5 percent in 2012, estimates it at 36.9 percent in 2015, and expects it to fall back to 33.8 percent by 2018.