WARC has downgraded its advertising revenue forecasts for 2025 and 2026 by almost $20 billion, citing recessionary concerns, regulatory headwinds and tariff wars.

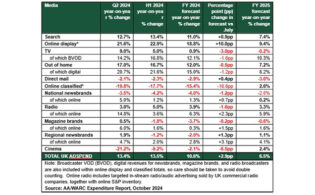

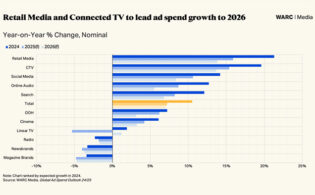

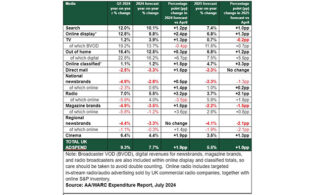

WARC projects ad spend will rise by 6.7 percent this year to $1.15 trillion, a downgrade of almost 1 percentage point from the November 2024 forecast. A further downgrade of 0.7 percentage points was applied to the 2026 forecast, lowered to 6.3 percent.

WARC cites the rising risk of stagflation or recession in several major economies, compounded by the U.S.-led ramp up on tariffs, as well as tightening regulations in the European Union, squeezed margins and low business and consumer confidence.

James McDonald, director of data, intelligence and forecasting at WARC and author of the report, said: “The global ad market faces mounting uncertainty as trade tariffs, economic stagnation and tightening regulation disrupt key sectors—leading us to cut growth prospects by $20 billion over the next two years. Automakers, retailers and tech brands in particular are now reigning in ad spend amid rising manufacturing costs and mounting supply chain pressures.”

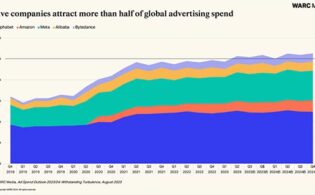

McDonald added: “Despite the growing volatility, digital advertising remains strong, led by three companies—Alphabet, Amazon and Meta—on course to control over half of the market in 2029. Regulatory scrutiny and uncertainty around TikTok’s future in the U.S. further compound risks to growth, however, advertisers must be nimble in order to seize initiative in this shifting landscape.”