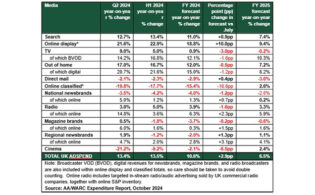

Advertising revenues in the U.K. are forecast to rise by 9.2 percent in the second quarter to £9.7 billion ($12.5 billion), according to the Advertising Association/WARC Expenditure Report, powered by the Euros and the general election, with a 7.7 percent gain projected for the full year.

U.K. advertising spend reached £9.2 billion ($11.8 billion) in the first quarter, a 9.3 percent gain and reflecting a new high for the period, with online driving stronger-than-expected gains. In the first half, the AA/WARC report projects adspend will be up 9.3 percent to £18.9 billion ($24.3 billion).

For the full year, the report projects advertising revenues of £39.4 billion ($50.7 billion), an upgrade of 1.9 percentage points since the April forecast, lifted by digital and increased investment around the Euros. Of note, BVOD advertising within the TV segment is on track to top £1 billion for the first time, a 13.7 percent gain. BVOD was up 19.2 percent in Q1, with TV up 1.2 percent. TV is expected to be up 3.9 percent in 2024, with BVOD up 13.7 percent.

In 2025, the U.K. ad market is expected to climb by 5.5 percent to reach £41.6 billion ($54.5 billion), an upgrade of 1 percentage point from the April forecast.

Stephen Woodford, chief executive of the Advertising Association said: “It is welcome news to see real-term growth and upgraded forecasts in the advertising market in Q1 this year, a positive sign that our industry is one of the driving factors in the U.K.’s economic recovery. This is a timely reminder of its dynamism as the new government seeks to create an environment for growth, through political stability and a new industrial strategy. Advertising is a U.K.-wide industry, with three in five advertising jobs based outside of London and it is central to the successful development of the digital economy across the whole country.”

James McDonald, director of data, intelligence and forecasting at WARC, added: “The race for AI adoption has intensified in the advertising industry, with major online platforms introducing their own solutions to market and subsequently reporting a positive contribution to their bottom line. The true impact of these tools will emerge in time, though first quarter results were certainly lifted by higher ad loads and associated performance costs online.

“That said, the enduring strength of legacy display media—chiefly TV, out of home, radio and cinema—was also evident in the first quarter, and we expect this to have sustained into the second due in part to short term stimuli such as the Men’s Euros and snap General Election. Overall, our outlook for the coming year is brighter than our last projection in April, with a forecast 7.7 percent rise in total ad spend this year ahead of the average rate recorded before the pandemic.”