GroupM is now projecting global advertising revenues to be up by 19 percent this year, a “significant upward revision” of its December forecasts.

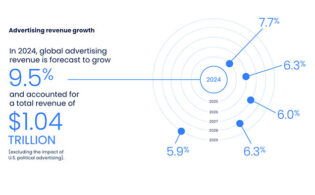

The mid-year This Year Next Year report indicates that this year, global ad revenues will be 15 percent higher than the 2019 pre-pandemic levels. In 2026, global advertising revenues will top $1 trillion, GroupM projects, up from $641 billion in 2020.

“Midway through 2021, it has become apparent that the market is growing much faster than we expected and from a larger base than we previously believed,” the report said. “While many of these growth factors were in place before last year, the pandemic has proven to be an accelerant.”

The digital ad market has benefited from expansions of app ecosystems, rapid small business formation activities and the growing role of cross-border media marketplaces, GroupM said.

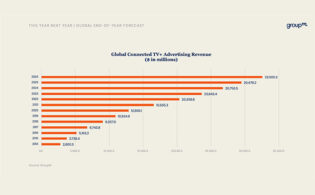

“Other changes are taking root as well,” the report continued. “Traditional TV network owners are prioritizing investments in content delivered on streaming services. While many of them will offer some ad inventory and capture a share of total TV advertising, those gains will only offset reduced spending on the traditional form of the medium. Consequently, we see faster growth in Connected TV+ advertising (what we previously called ‘digital extensions of traditional TV’) than previously forecast, but total television advertising will generally be stable or slow-growing.”

Television advertising is projected to increase by 9.3 percent this year, versus a previous 7.8 percent forecast. Going forward, GroupM sees low single-digit growth for the medium, including Connected TV+. GroupM expects Connected TV+ ad revenue will increase to $31 billion globally by 2026.

“TV’s unique reach advantage is set to erode at a relatively rapid pace in the near term as investments in ad-free or ad-light streaming video services—mostly U.S.-based—dominate the global industry going forward.”