Global advertising spend is expected to top $1 trillion for the first time in 2024, with expenditure on connected TVs (CTV) expected to be among the key drivers.

The WARC Global Ad Spend Outlook for 2023/24 projects adspend will rise by 4.4 percent this year to reach $963.5 billion, with an 8.2 percent increase forecast for 2024. This year, just five companies—Alibaba, Alphabet, Amazon, Bytedance and Meta—will take a whopping 50.7 percent of the total pie, with that rising to almost 52 percent in 2024. For those five giants, ad revenues are expected to increase by 9.1 percent this year and 10.7 percent next year. For all other media owners combined, this year is projected to be on par with last year.

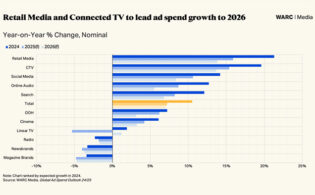

The ad market next year will be lifted by the U.S. presidential campaign and key sporting events, notably the Olympics and the UEFA Men’s Euros. In 2024, social media will be the fastest growing medium, rising by 12.8 percent to reach $227.2 billion, securing a 21.8 percent share of the pie. Linear TV will rebound somewhat after a 5.4 percent slip this year, rising by 3.5 percent to reach $163 billion. CTV advertising will increase by 12.1 percent to hit $33 billion. Combined, premium video will have an 18.8 percent share of total revenues, as compared with pure-play internet’s almost 68 percent share.

James McDonald, director of data, intelligence and forecasting at WARC, and author of the report, noted: “High interest rates, spiraling inflation, military conflict and natural disasters have made for a bitter cocktail over the preceding 12 months, but the latest earnings season shows that the ad market has withstood this turbulence and has now turned a corner. Our new measurements show how the fortunes of just five companies have a major bearing on the prospects of the industry at large, and that these companies are on course to record oversized gains in the coming months.

“With the establishment of retail media as an effective advertising channel, the advent of connected TV as the next evolution of conventional video consumption and the continued growth of social media and search, we are seeing once again the value advertisers place in leveraging first-party data to target the right message to the right person at the right time.”

North America will account for 32.8 percent of overall spend next year, with the U.S. at 31.3 percent, rising by 7.6 percent in 2024 to $326.7 billion. Europe will be flat this year but will see 3.6 percent growth in 2024 to $155.6 billion, taking a 14.9 percent share. Australia and New Zealand will see a 3 percent gain to $17.6 billion. East Asia will take a 17.6 percent share of the market, increasing by 5.7 percent next year to $183.1 billion, while South Asia will account for just 1.4 percent, increasing by 12.1 percent to reach $14.3 billion. Southeast Asia, including the key Indonesia market, will rise by 4.6 percent to $19.4 billion. The Middle East is on track to rise by 6.2 percent to $6.9 billion. Africa, expected to take an 11.6 percent hit this year, will rebound somewhat in 2024, increasing by 6.1 percent to reach $6.9 billion.