Speaking at MIP London today with media cartographer Evan Shapiro, Justin Sampson, chief executive of U.K. ratings service Barb, discussed trends in viewership and engagement across platforms, highlighting an expanded initiative to track YouTube viewing on the television set.

Barb, together with its research partner Kantar Media, is selecting 200 YouTube channels that will become part of its daily audience reporting beginning in Q3. The channels will be selected based on volume of viewing and categorized by the type of content creator.

“The streaming wars are over,” said Shapiro in his opening remarks before sitting down for a series of Q&As on streaming strategies, beginning with his conversation with Sampson. “Netflix won. Biggest subscription channel on the face of the Earth. The only one that’s truly profitable from a big streaming standpoint. Now. they’re turning into TV with football and wrestling and a slap match between a YouTuber and an old man. We are now in what I would call the Great Media War. The Great Media War is not necessarily between entities. It’s between mindsets. It’s between the models that we can’t seem to let go of and keep trying to recreate in this new user-centric era and the ones we have to build while we’re operating the businesses we have. Yes, we have to fly the plane and build a new plane at the same time. We have to let go of the things that are holding us back and move toward understanding the data that’s staring us in the face.”

Shapiro called Barb “the most comprehensive measurement of a television media ecosystem in any of the territories that I cover.”

Shapiro noted that 58 percent of the U.K. population is over 40; as such, “Boomers and Gen Xers disproportionately weigh the data for the total audience—long live public-service broadcasting and free TV.”

Across all screens, BBC still leads in terms of total audience at 24 percent, “but with all audiences, YouTube is now dependably the second place channel, and Netflix is dependably in the top four with ITV in between,” Shapiro said. “Two of the five top spots are taken up by streamers and/or social media. When you look at TV only, broadcasters do appreciably better, but Netflix and YouTube are in the top.”

Under and over 35s are two dramatically different ecosystems, Shapiro explained. Two very distinct audiences: one prefers apps and social video and one broadcast and broadcast apps. Channel 4 increased the amount of long-form content on YouTube, and the amount of content across all their social media platforms dramatically, and they saw a doubling of viewership on YouTube. They found that they were distinctly different audiences for broadcast and their apps. I encourage you to look at the two ecosystems that are being built in this territory and look at how you address the two different audiences—those under 35, the generation that grew up on social media, and the ones who are still using the traditional outlets of broadcast and pay TV.”

Sampson weighed in on the increasing usage of YouTube on TV sets. “Here in the U.K., 41 percent of all YouTube viewing is on the TV set,” with some of that being driven by kids.

“That co-viewing that you just highlighted to me is one of the ways that the younger generations are going to influence the larger sample,” Shapiro said.

Co-viewing isn’t as high on VOD services like BBC iPlayer or ITVX, Sampson explained.

Shapiro pointed to another trend in the Barb data he analyzed: “Broadcast has demonstrated real agility when it comes to streaming. Close to 50 percent of streaming for over 35s is broadcast or pay-TV apps.”

Sampson noted that many of the big broadcast shows are also resonating with the 16-to-34 set on VOD players.

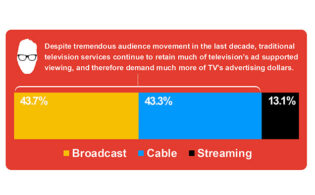

“The frustration of the traditional media players in this moment is competing against the creator economy,” Shapiro said. “Traditional television still relies on that mass audience, that collective shared experience, especially from a commercial standpoint.”

Sampson pointed to the importance of known brands in driving streaming viewership. The Simpsons, Friends, Bluey, The Office and Brooklyn Nine-Nine collectively account for 5 percent of all viewing on the big five SVOD streamers. “That shows the importance of having shows that people constantly come back for. This is true as well for younger audiences.”

Sports plays a similar role, driving streamers’ increasing investments in this space.