Ad tiers, bundling and superstreamers are set to reshape the media and entertainment landscape in the year ahead. “#AdvertisingEverywhere is where we are,” Tony Gunnarsson, senior principal analyst for TV, video and advertising at Omdia, said during his insightful presentation at Asia TV Forum’s Leaders Dialogue sessions in Singapore earlier this month, noting that this year had been one of “reassessment” after a transformative few years of the streaming wars and subsequent SVOD fatigue.

“By the end of 2024, all the big streamers will have advertising tiers, certainly in all the key international markets,” he noted. The move toward bundles, meanwhile, such as the Disney+/Hulu/Max one in the U.S., “is the first step toward a rebundling. These companies that have invested in exiting from a profitable pay-TV bundle to a direct-to-consumer competitive market are open to working together again. I predict we’ll see many more of these bundles in 2025. Should that happen, we’ll see greater rebundling of TV and video.”

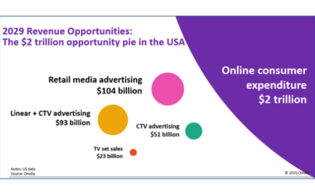

The media and entertainment market will top $1 trillion in revenues by year-end, a 7 percent growth rate. “Advertising is key here. Online video is the biggest area,” accounting for $392 billion in revenues, followed by traditional television at $327 billion.

Omdia expects a 5 percent growth rate for next year, with advertising revenues remaining key.

Breaking down the $356 billion global video advertising pie, $135 billion will go to linear TV, $140 billion to social media, $34 billion to premium AVOD and $6 billion to FAST. Online video is the largest and fastest-growing media segment as pay-TV advertising declines. Social video, SVOD and premium AVOD will drive those gains.

TikTok is a key player in the social video space. The service already ranks among the top five video platforms in major territories worldwide.

“Next year is the first year when the combined total from streaming—including advertising and subscriptions—is going to be greater than pay TV,” Gunnarsson explained. That is the global view; in Asia, pay TV is still a viable business model. “Pay-TV revenues are going to dominate well into the 2030s,” Gunnarsson told me.

Drilling deeper into the streamer landscape, Gunnarsson said that ad tiers would be paramount for the big five SVODs as they seek to balance ad and subscription revenues. In 2025, about 30 percent of subs to the big five will be on ad tiers, Omdia predicts, heavily skewed by Amazon’s Prime Video.

“We’re going to see consumer tolerance of advertising increase over the next five years,” he continued.

From next year, Gunnarsson expects streamers to abandon DTC approaches in new markets in favor of partnership models. He also expects consolidation in the streaming services market, with the number of platforms peaking at 6,191 in 2019 and sliding to 5,664 this year. As of this year, just five services will have more than 100 million subs, with 24 having more than 10 million and 109 having more than 1 million. “This is a fiercely competitive landscape already—how do you enter? I’d argue it’s impossible.”

For the services that are still expanding globally, partnerships will be paramount. Another key theme to watch is the emergence of the superstreamers—services that are “being marketed as pay 2.0,” mainly through an emphasis on live sports and delivering content for all members of a family across multiple genres.

Gunnarsson also spoke about a “renewed interest in SVOD aggregation” across services like Amazon Channels and MagentaTV in Germany and bundles like the one offered by Disney and Warner Bros. Discovery in the U.S. “This is something we’ll see more of. I’m predicting international versions of these bundles next year.”

These will benefit consumers from a price standpoint, but Gunnarsson noted significant subscriber frustration with discovery, app differences across devices, complicated user interfaces and more. Subs are taking anywhere from two to four services per household.