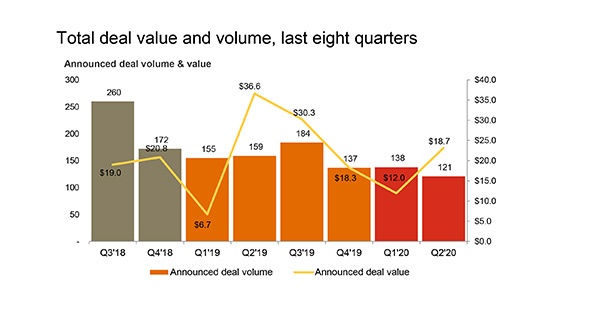

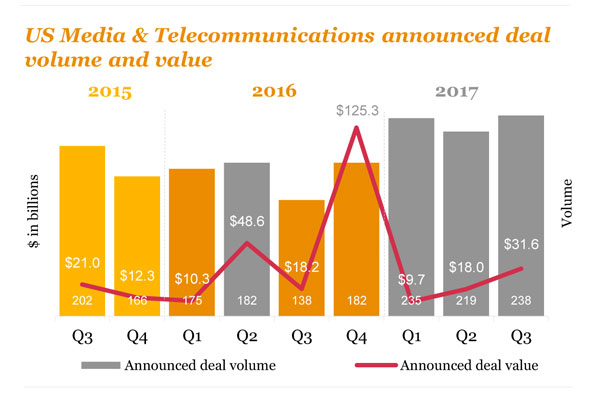

While deal volume in the U.S. media and telecommunications sector declined slightly in the second quarter, the value of merger and acquisition activity was up, fueled by megadeals, PwC said in a new report.

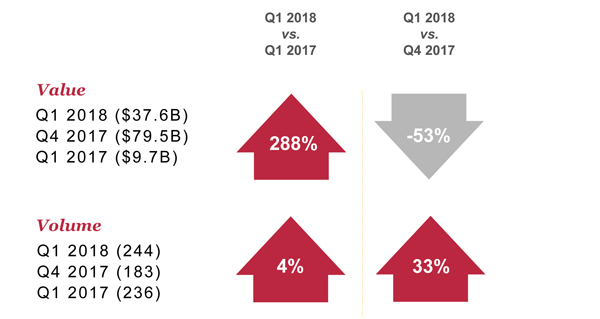

Second-quarter deal volume declined by 20 percent from the prior quarter, with 194 in Q2 2018. This decline was after reaching a two-year high in Q1 2018, at 244.

Deal values, meanwhile, increased 19 percent compared to the prior quarter, fueled by megadeal activity. Q2 deal value rose to $44.9 billion.

Bart Spiegel, U.S. Media and Telecommunications Deals partner at PwC, said: “Blockbuster deals dominate the headlines as consolidation continues to play itself out all across the media and telecom landscape. Key market players are evaluating their position and deciphering their next move in a very dynamic ecosystem while keeping a close eye on how regulators address several pending transactions.”

Megadeals accounted for approximately 66 percent of year-to-date announced deal value. Ten deals greater than $1 billion in value were announced during the first half of 2018. There were three announced deals in the first half of 2018 in excess of $5 billion, accounting for $54.3 billion, or 66 percent, of year-to-date deal value. Comparatively, there were no megadeals in the same period a year ago.

PwC’s U.S. Media and Telecommunications Deals Insights Q2 2018 report noted that megadeals are moving ahead despite regulatory uncertainty, citing in its executive summary that “recent appeals put into question whether we have fully cleared the hump of uncertainty around the political and regulatory environment when it comes to mega-consolidation.”

The advertising and marketing and internet and information subsectors continued to lead in deal volume in H1 2018, with 143 and 97 announced deals, respectively.

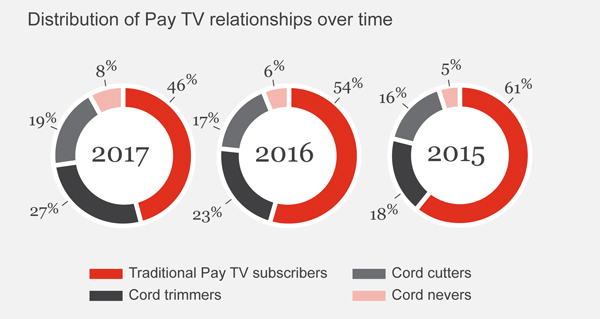

TVUSA

TVUSA