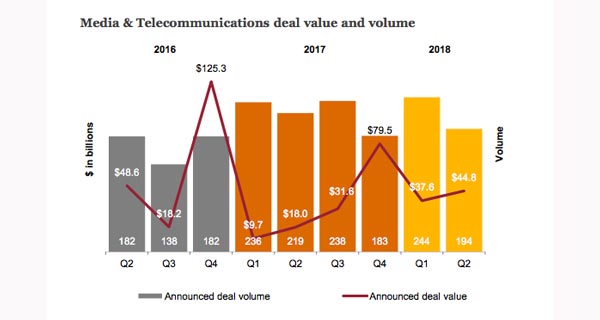

There were 238 M&A deals in the U.S. media and telecommunications space in Q3, PwC reports, a 9-percent gain on the previous quarter.

The number of deals marks a two-year high, with deal value rising by 76 percent to $31.6 billion. Megadeals accounted for approximately 83 percent of announced deal value, among them Discovery’s $11.8 billion acquisition of Scripps. The quarter saw a total of seven deals valued at $1 billion or more.

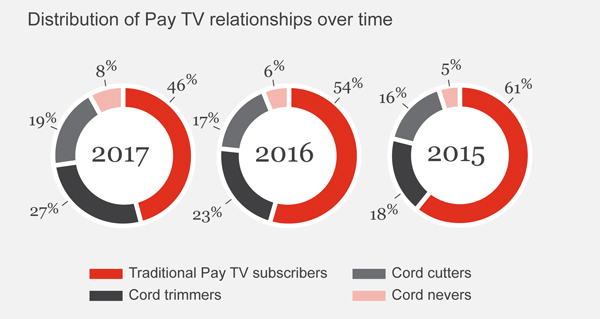

“While the shift to digital was all the rage only a couple of years ago, market participants are realizing that a compelling digital platform may only be part of the solution and won’t satisfy sophisticated investors and stakeholders,” PwC said in its U.S. Media and Telecommunications Deal Insights Q3 2017 report. “The ultimate goal: taking that sticky digital platform you’ve built or acquired and maximizing the underlying data to (i) improve customer engagement and (ii) identify direct or tangential service offerings, which can improve the monetization of said user base.”

PwC continues, “Given the pace of innovation, existing talent outside their organizations and access to capital, many are looking towards M&A to help accelerate this strategy. These attributes, along with several others, are what drove M&A this past quarter and will likely continue for the foreseeable future.”

There were 13 broadcasting deals in the period, valued at $12.2 billion. “This was the most active quarter for the sub-sector in two years,” PwC said. “Of the 13 announced deals, roughly half of the targets were radio stations, including online stations. In most cases, the acquirers were other radio broadcasters looking to consolidate, gain access to new markets/audiences and achieve certain cost synergies.”

In the film/content space, there were 17 deals valued at $153 million.

TVUSA

TVUSA