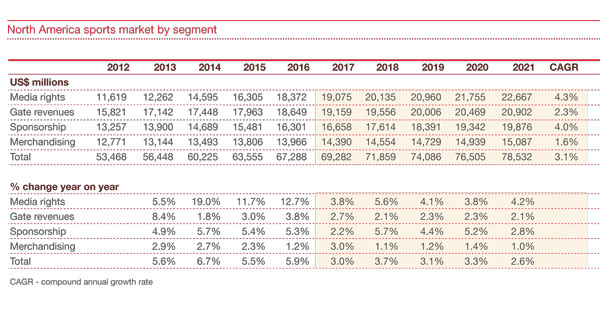

Live sports is one of the main reasons consumers are holding onto their pay-TV packages, PwC says in a new report, adding that “cord cutting has more momentum than ever before.”

PwC’s Consumer Intelligence Series: I stream, you stream report found that 73 percent of the almost 2,000 U.S. consumers surveyed subscribe to pay TV, down from 76 percent last year and 79 percent the year before. The same percentage of people also subscribe to Netflix. Another key finding is that 82 percent of sports fans would end or trim their pay-TV service if they no longer needed it to access live sports. And 75 percent said they can’t handle using more than four services in addition to a pay-TV package.

People report that they’re paying more for video today than they were last year, PwC says, adding that 53 percent of cord trimmers are actually paying more for video than they did in 2016.

Streaming continues to rise among all demos, but PwC says that “consumers are showing signs of being overwhelmed. While respondents indicate they have four services on average—including pay TV and digital services—they only watch about two of those services on a regular basis. Just a quarter of consumers say they can handle using more than four services in addition to pay TV. Looking for content only adds to the burden.”

PwC also notes that subscribers are becoming more appreciative of the ease of pay TV, which “solves many of the issues that surround streaming, creating a relaxed and efficient viewing process. Pay TV spin-offs that can provide viewers with the best of both worlds are poised for success.”

When it comes to what drives the success of a streaming service, respondents are more drawn to having a wide variety of content versus exclusive content, and only 35 percent said that original programming is “very important” in their decision to subscribe to a platform. “In fact, exclusive or original content might draw consumers to free trials or temporary subscriptions, but won’t necessarily garner loyalty. Services that focus on long-term brand building alongside content development can avoid situations like this. Viewers are most eager to watch—and pay for—a streaming service from a brand that already has an established presence with unique content. This reinforces the idea that powerful branding can drive success in a sea of clutter.”

Looking at sports, PwC says that live coverage is helping to keep consumers connected to the cord, “but with respondents so eager for premium streaming services from brands like the NFL, the evolution of live streaming in sports might mean an even more precipitous decline in pay-TV subscriptions.”

PwC says the average sports fan would shell out $23 a month for unlimited access to live sports on any platform, and more than half want access to more interactive content.

TVUSA

TVUSA