Uday Shankar, the president of The Walt Disney Company APAC and chairman of Star and Disney India, discussed the early success of Disney+ Hotstar and weighed in on the impact of COVID-19 on the media business in his session at the APOS 2020 Virtual Series.

Shankar was interviewed by Vivek Couto, executive director of Media Partners Asia (MPA). On the effects of the coronavirus pandemic, Shankar observed, “Media was massively overdue for a change. The transformation was long overdue—in our strategy, in our ways of doing business. Muscle memory and the inertia generated over all these years has kept us going. COVID-19 and the disruption it has caused has brought the spotlight back firmly on that. We’re all thinking about how to get back. That’s a great opportunity. The question is how many of us will be able to take advantage of that opportunity. Those who do not will pay the price.

“There are two or three areas of opportunity,” Shankar continued. “If you look at the rest of Asia, outside of India, pay TV has been facing lots of challenges. If anything, COVID will accelerate those challenges further. The dependence in India and other parts of the world on ad sales was very high. In India, it’s disproportionately high. As a result of COVID, it will be several quarters if not a couple of years before we go back to the old levels of advertising, if at all. People will have to think of different business models to make money.”

An even greater opportunity lies in the approach to content creation itself, Shankar said. “I’ve been somewhat of a critic of the ways of approaching creativity. All over the world, less so perhaps in Asia, investment of cash has become a substitute for creativity in general. There’s so much money that’s been going into creating content. That makes the breakeven cost of a business so high that the market cannot sustain it. This is an opportunity for everyone to revisit the cost model. The use of technology has been brought front and center. How do we use this technology, not just as an input, but to reinvent our business model, our broader approach to product and creativity, keeping new technology at the center?”

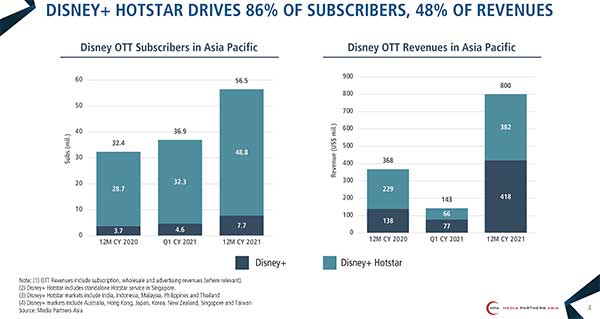

Asked about what success means for Disney in the streaming space in AsiaPac, Shankar responded, “We are very clear that in this part of the world, a price-sensitive part of the world, the biggest metric of success is how many subscribers can you get. The Walt Disney Company’s digital initiatives in this part of the world, between Hotstar and Disney+, are off to a great start.”

Hotstar was a first-mover in the Indian OTT space when it launched five years ago. “The market wasn’t ready for streaming,” Shankar said. “The popular wisdom was India just didn’t have the bandwidth. But we believed in India, in the power of India and the tendency in India to leapfrog. Our instincts were right. What Jio and others have done is to completely transform one of the biggest laggard markets in data into probably the most exciting data market in the world. We’re benefiting from that.”

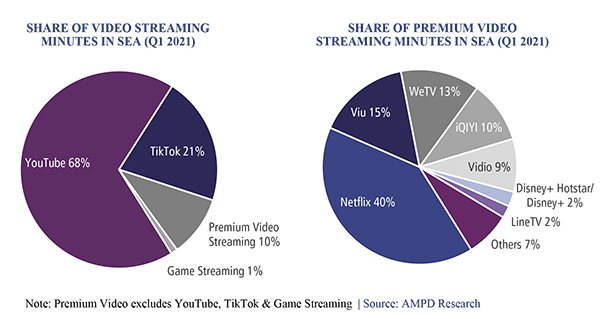

Disney+ arrived on Hotstar mid-pandemic, Shankar continued. “The whole country was in lockdown. Advertising was interrupted. We could not do the marketing plans we had. The live sports we wanted to leverage for the launch of Disney+ Hotstar weren’t available. And today we are the biggest streaming service in India. I think we are well-positioned for The Walt Disney Company to create a completely different level of digital ecosystem. The only benchmark is, can Disney+ Hotstar compete with our television channels in terms of their reach, delivery and consumption? I think eventually if streaming has to become really mainstream and has to serve the local population at scale and has to become sustainable in business terms, that’s the only metric everyone will have to follow. Can it become a real alternative to pay TV and broadcasting?”

Television, Shankar added, is not going anywhere, particularly in India and other parts of Asia. “I’m not ready to give up on TV. Television will undergo correction, the business models need to get fixed. However, in markets like India and other parts of Asia, television still has a fair bit of runway. Now television will also have to compete with streaming services. Some streaming services will emerge as real challengers. In India, Southeast Asia, all these markets, we’re very focused on making sure that Disney+ and Hotstar can compete with television.”

Shankar also addressed the regulatory environments in parts of Asia that can often serve as barriers to entry and innovation. “I’ve been critical of a lot of things on the regulatory side,” he said. “First and foremost, the regulators need to have clarity and they need to share that clarity with the media community. What are they regulating? What is the agenda? What is the reason for regulation? [In India it often feels] like regulation is just to create hurdles in the growth of business. Regulation is first and foremost for creating a level playing field, it is to promote the interests of consumers at large. Unless you have clarity and everyone understands exactly the boundary conditions within which a regulation will operate, it creates all kinds of confusion and setbacks to the industry. Media is a sector where if the industry doesn’t do well, if it suffers, the first victims are consumers. My biggest frustration is that it has become totally opaque: why is the regulator regulating something? And then there is no consistency. You can’t keep shifting the goalposts.”

On the other hand, though, “The industry, especially on the content side, also cannot operate in a vacuum. They have to be aware of the sensitivities in each market. Asia poses a complicated challenge because there’s so much diversity, so many countries, religions, ethnicities, and it’s tough to create content that meets the expectations. I’m a big believer in complete freedom of media, but with freedom comes great responsibilities, right? All content creators, all people who offer content to the consumers, must be mindful of their social responsibility.”

AsiaPac remains a key priority for The Walt Disney Company, Shankar said. “We’re very clear that this is one of the most exciting regions of the world, if not the most exciting. We are very well positioned. Our brand is extremely strong and highly respected. Also, creativity and the ability to innovate are very deeply embedded in our genes. We have a great future. The thing we need to keep working on is technology. How cutting edge we can be. Between Hotstar and Disney+ and other assets, we’ve had a great start. This is something where we have to be relentless.”

On India specifically, he said, “Our agenda is to compete with television. We have the biggest presence in television in India, and we want to be the biggest competitors to television ourselves. Our view is we can do this successfully. We have the best combination of cricket, live sports beyond cricket, the most-watched drama and movies, and we also have the best talent bench. We should be able to very rapidly get to a number in terms of both reach and access that is as much as any of the frontline mass-market entertainment channels in this country.”

The Star entertainment channels have about a 20 percent share of the 150 million to 160 million homes connected to pay TV in India, Shankar noted. “On streaming, which is largely mobile-driven, there are already many more smartphones and video-enabled phones. That number over the next few years can be as much as 700 million 750 million. So the size of the screen universe is much bigger than TV. So streaming, if done right, has the potential to be bigger than TV, purely in terms of the number of consumers and the amount of time spent with you.”

On the willingness of people to pay for content, Shankar responded: “When Star started pushing pay TV aggressively, the wisdom was, people won’t pay for content. And then we launched sports, and that’s exactly what people said. When we were taking Hotstar from largely AVOD to AVOD plus SVOD, we were told, no one will pay for content. Research agencies told us, when people pay for data, it means they have paid for content as well, so they were not going to pay a second time. But in our experience, our SVOD service has taken off remarkably well. That is why we have the confidence and the courage to invest more in it and ramp it up further.

“Pricing is a very important factor,” he added. “A lot of global companies have realized that global pricing doesn’t work. But the beauty is, what you trade down by way of individual ticket size you can get by the size of the consumer base.”

TVASIA

TVASIA