Vivek Couto, executive director of Media Partners Asia, discussed key trends in AsiaPac’s video industry at the official APOS opening this morning and weighed in on factors that will impact the future of the business.

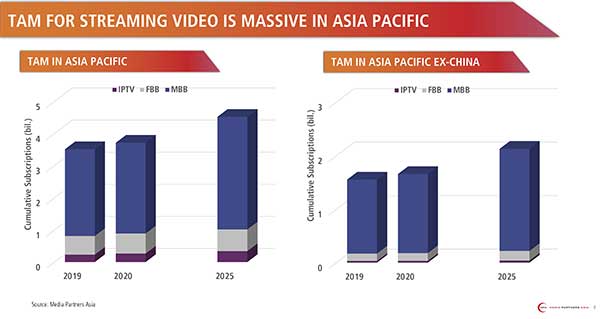

“One of the biggest changes we’ve seen in our industry over the last few years is the transition from household-based consumption to individual usage-based consumption, driven by mobile and broadband connectivity and devices,” Couto said. That has impacted not only how content is consumed but also on the “path to monetization,” he said. “The other big battle is the one for wallet share.”

Couto also referenced the dramatic changes in the telecoms business, as voice and SMS revenues have fallen but broadband and data revenues are rapidly rising.

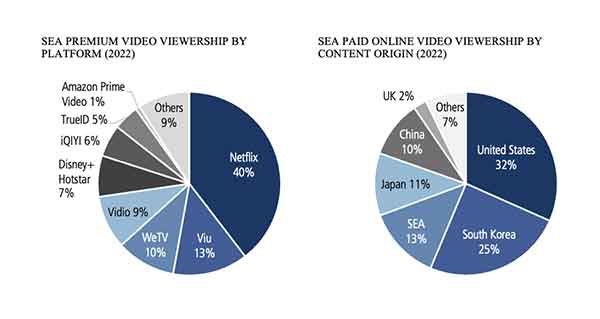

He looked at how various digital platforms have fared in Asia. Of Amazon Prime’s 100 million global members, about 25 percent are in AsiaPac, Couto said. Hotstar will have a 20-percent share of India’s online video advertising market year-end with about 5 million paid subs. About 10 percent of Netflix’s subs will be in this region by the end of 2018. Viu has 16 million monthly active users, 70 percent of which are in the region. And for YouTube, 35 percent of its 1.5 billion monthly users are from Asia.

Pay-TV subscription revenues are in decline across Asia, while online video subscription revenues are rising from a small base. “2016 to 2018 has been pretty tough for television on the advertising side, but we expect it to rebound in certain Southeast Asian markets,” he said.

“At the same time, content investment for both TV and online video is expected to remain at a reasonable level from 2016 to 2018.” Content spend on movies, entertainment and sports will rise from $23 billion in 2017 to $31 billion by 2023. “It’s largely anchored to new dollars being spent across digital video, which will account for 20 percent of content investment” in five years time. Sports rights have been key to that spend, “but a lot of the dollars on entertainment and originals are also going online.”

In Australia, the high ARPU legacy pay-TV industry “is transitioning to a digital ecosystem. Having said that, sports rights are moving to pay TV. That is going to slow down the erosion in pay TV for some time.”

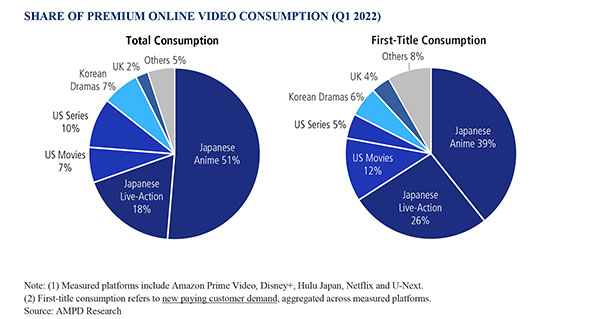

In Japan, the free-to-air business is being challenged, “particularly in the face of advertising declines. But the export of content is starting to offset some of that decline.”

The export of Korean content is driving investment there, Couto noted.

On India, Couto said, “macroeconomics, digitalization and consolidation are driving content growth and distribution growth. Live sports rights are helping the digital pay-TV ecosystem. We’re expecting double-digit growth will continue in India over the next few years, fueled by large online video and TV advertising.”

Content investments in Indonesia are expected to rise, Couto said, noting that MPA remains “very cautious” about the country’s online video sector. “We think more of the model in Indonesia is going to be funded by incremental advertising growth.”

Going forward, consolidation is key for scale, regionally and globally, Couto said. Internet TV will continue to drive incremental growth in the business, he added. There will be fewer investments in pure-play video, Couto noted, “companies with local scale that can withstand disruption are going to be strong drivers of change in the future, particularly in a more consolidated market.”

TVASIA

TVASIA