The number of SVOD subscribers in Japan grew to 49.4 million in Q3, with Prime Video still the leading player in the market, followed by Netflix and then Disney+ ascending to third place, per new data from Media Partners Asia (MPA).

Japan Online Video Consumer Insights & Analytics reports that Disney+ ended Q3 with 3.6 million subscribers, behind Prime Video’s 16.5 million and Netflix’s 7 million and displacing Hulu Japan as the third-largest platform in the market. Disney+’s gains were driven by its kids’, Korean and U.S. franchise brands. Other key local SVOD platforms include U-Next and Abema TV. The local broadcast TV consortium TVer leads local AVOD.

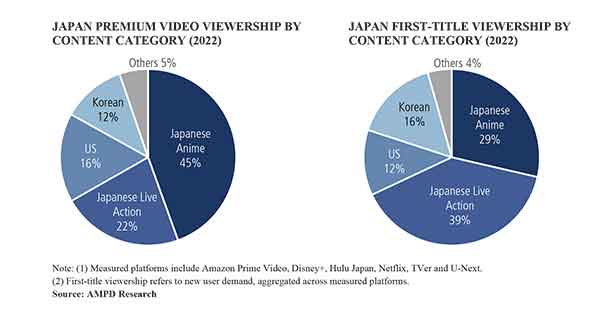

Japanese anime continues to dominante premium online consumption, taking a 44 percent share in the quarter, followed by Japanese live action at 18 percent. Korean series scored a 14 percent share, ahead of U.S. series at 10 percent and U.S. movies at 7 percent.

Vivek Couto, executive director of MPA, noted: “Ex-Disney+, SVOD growth in Japan was relatively flat over Q2 and Q3. Amazon Prime Video continues to lead the category, followed by Netflix, both leveraging large, non-exclusive anime libraries to drive consumption. Local TV consortium and AVOD platform TVer continues to grow its share of premium video consumption, meeting demand for TV live streams and catch-up of popular variety and drama programming. Licensed TV content also drives subscriber acquisition on Hulu Japan and U-Next. Notably, Korean dramas play an outsize role in subscriber acquisition for Netflix and Disney+, providing competitive differentiation amidst largely non-exclusive anime libraries. Disney+ has also started to build an exclusive anime library, underscoring strategies towards content differentiation in a maturing SVOD environment.”

TVASIA

TVASIA