The premium VOD landscape in Southeast Asia is experiencing a resurgence, per new data from Media Partners Asia (MPA)’s ampd digital measurement platform, with paying subscriptions rising to 48.5 million.

Premium VOD viewership in Southeast Asia reached 96.3 billion minutes in Q1. MPA notes that the base of paying subs increased by 652,000 from the previous quarter and 1.6 million year-on-year. Total subscription revenues increased by 9 percent year-on-year and 5 percent quarter-on-quarter to reach $381 million. The markets leading the region’s gains are Indonesia and the Philippines.

“Following a challenging period in 2023, the Southeast Asian premium VOD sector has demonstrated resilience and notable improvements since Q4 2023, a trend that has continued into Q1 2024,” said Vivek Couto, managing director of MPA. “We’ve observed better monthly customer churn metrics, alongside a robust growth in subscribers and subscription revenues. Investment in local content and marketing has been strategic and for the most part, sustainable while leading platforms continue to invest in local entertainment and sports.”

Netflix remains out front with 49 percent of premium VOD subscription revenues and 10 million subs in the region. Regional heavyweight Viu is second with 9.1 million paying members. Disney+ grew revenues despite subscriber churn, with an 11 percent share of premium VOD revenues. Local player Vidio leads in the key market of Indonesia with 4.1 million customers thanks to its lineup of premium sports content and local dramas.

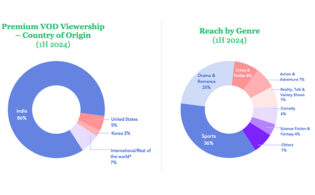

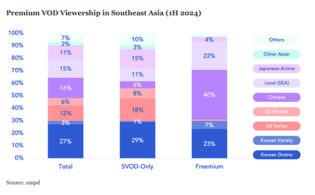

Korean and U.S. content continue to drive customer engagement, the report found. Korean dramas captured some 27 percent of premium VOD viewership, followed by U.S. content, with American series at 16 percent and movies at 7 percent. Chinese content is picking up traction, landing 16 percent of usage, with Southeast Asian content not far behind at 12 percent and anime at 11 percent.