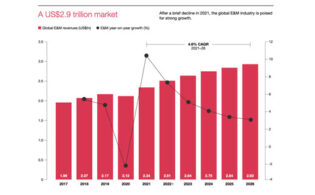

The global entertainment and media (E&M) business is rebounding from a Covid-19 pandemic slump, according to PwC, with revenues on track to rise by 6.5 percent this year and 6.7 percent next year.

According to PwC’s Global Entertainment & Media Outlook 2021-2025, the gains are being driven by strong demand for digital content and advertising. E&M revenues will rise by a compound annual growth rate (CAGR) of 5 percent between 2021 and 2025, topping $2.6 trillion. This comes following a 3.8 percent drop last year, the biggest year-on-year decrease in the 22 years PwC has been producing its five-year outlooks.

Traditional TV/home video will remain the largest E&M consumer segment, with revenues of $219 billion, but it will contract by a 1.2 percent CAGR from 2021 to 2025.

Video streaming, meanwhile, is booming, with SVOD projected to grow at a CAGR of 10.6 percent to $81.3 billion in 2025. “While 2020 was a year of extreme growth for OTT video, with more than $12 billion added to the market, the next few years will require providers to find new and innovative ways to secure access to consumers as consumption subsides to pre–Covid-19 levels,” the report notes.

Cinema revenues will rebound in 2021 but a recovery to pre-pandemic levels is not expected until 2024. Video game and e-sports revenues are also a key driver of E&M revenues, set to reach almost $200 billion by 2025. The fastest-growing segment is VR, with a projected 30 percent CAGR to reach almost $7 billion in 2015.

Werner Ballhaus, Global Entertainment & Media Industry Leader Partner at PwC Germany, said: “The pandemic slowed the entertainment and media industry last year, but it also accelerated and amplified power shifts that were already transforming the industry. Whether it’s box office revenues shifting to streaming platforms, content moving to mobile devices, or the increasingly complex relationships among content creators, producers and distributors, the dynamics and power within the industry continue to shift. Our Outlook shows that the hunger for content, continued advances in technology and new business models and ways of creating value will drive the industry’s growth for the next five years and beyond.”

PwC urges E&M players to keep track of potential regulatory shifts as they plan for the future. “Even in the areas that offer the most compelling topline growth—like video streaming—the nature of competition is likely to change dramatically over the coming years,” Ballhaus added. “And all the while, the social, political and regulatory context in which all companies operate continues to evolve in unpredictable ways. All of which means that sitting still, relying on the strategies that created value and locked up market share in the past, will not be the most effective posture going forward.”