Netflix and Amazon’s Prime Video accounted for more than half of all SVOD commissions globally in Q1, according to a new report from Ampere Analysis.

Q1 saw Netflix commission its highest number of new titles since Q3 2021, while Prime Video hit a new record for its quarterly commissions. The gains for those streamers come as others continue to commission fewer originals.

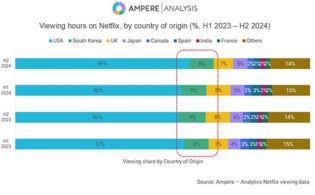

Ampere notes that the new data reflects an increased investment in originals outside of the U.S. for Netflix and Prime Video as they chase international expansion amid a slowdown in new U.S. subs. Both platforms ordered the majority of their new originals outside of the U.S.

At Netflix, Western European commissions were almost on par with the U.S. for the first time in Q1. Key European markets for the streamer include the U.K., Spain and Germany, with cost-effective unscripted featuring heavily in the mix. (Docs accounted for 30 percent of orders from the region, up from 23 percent last year.) Unscripted commissioning from the U.K., however, accounted for just 43 percent of the region’s doc commissions, down from 78 percent last year. There was also a notable uptick in AsiaPac, namely Thailand. In India, which is expected to be Netflix’s largest AsiaPac subscriber hub, the platform is focusing on crime and thriller content. Ampere also notes that Netflix is increasingly reliant on pay-one agreements with studios for its supply of exclusive U.S. films as it decreases its domestic film commissioning. The platform has, however, expanded its international movie orders in the Nordics, AsiaPac and Africa.

At Prime Video, India remains the key focus, with 37 titles. Amazon is investing heavily in Indian movies as well via pay-one and co-financing deals with local theatrical distributors. In Western Europe, Germany is seeing increased attention with 13 orders in Q1.

Mariana Enriquez Denton Bustinza, senior researcher at Ampere Analysis, noted: “The market saturation in North America, the growing cost of production and the lingering impact of the Hollywood strikes have pushed Netflix and Amazon to increase investment in international productions to stimulate subscriber growth. While several studio-backed SVoDs have made cutbacks internationally, these two streaming giants are doubling down on their localized global strategy. For Netflix, this means catering to a broad subscriber base while leaning on markets whose productions offer the greatest potential for crossover appeal. Meanwhile, Amazon’s approach remains more heavily targeted towards key markets such as India, while it leverages its global position to expand further into the theatrical market to generate downstream revenues from its platforms.”