Strategy Analytics has revised its global SVOD projections as stay-home measures related to the COVID-19 pandemic drive an increase in subscriber take-up.

The forecast for global subscriptions was increased by 5 percent as compared with the pre-pandemic model. Strategy Analytics now expects 949 million paid subscriptions globally by the end of 2020.

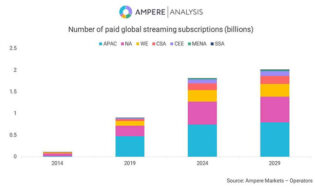

Longer-term, SVOD subs will rise by 621 million between 2019 and 2025 to reach 1.43 billion. The share held by China and the U.S. will fall from 65 percent to 55 percent as other markets, notably Southeast Asia, see gains. China will remain the largest market, with 438 million paid SVOD subs by 2025, followed by the U.S. with 342 million.

“One significant factor affecting future SVOD growth is the impact of the Coronavirus in both the short and long term,” said Michael Goodman, director of TV and media strategies. “In the near term, the Coronavirus will actually boost SVOD subscriptions, as well as viewing of these services, as an ever-growing number of consumers adopt social distancing or are forced into quarantine. In the mid-to-long term much depends on the length of the pandemic and resulting economic damage. As businesses shut down and individuals are laid off consumers are going to have to make hard decisions about how they spend their money and as wonderful as Netflix, Amazon Prime Video, Disney+ and other SVOD services may be, they are not essential services.”