European broadcast groups should refrain from cutting content costs and must “embrace streaming” in order to stem audience erosion, Ampere Analysis says in a new report.

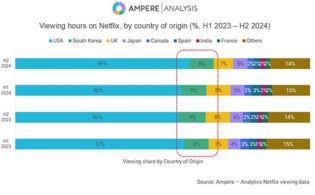

Commercial broadcasters have seen a 16 percent decline in consumer engagement across Europe’s top five markets since 2016, Ampere reports. Since then, their investments in content have fallen by 19 percent to reach €8 billion last year. Ampere projects that spending by SVOD platforms is expected to hit €10 billion in Europe’s major TV markets this year.

Ampere notes that broadcasters have an opportunity now to play catch-up amid a slowdown in streamer investment. “Industry giants including Netflix, Disney and Warner Bros. Discovery are scaling back streaming spend growth to ensure sustained profitability, paving the way for national broadcasters to capitalize on this shift,” Ampere says. “Sustaining or increasing content investment is crucial for broadcasters to differentiate themselves in an industry where major global streamers are adopting more conservative spending strategies. Bold commissioning decisions can set broadcasters apart, drive engagement and advertising revenue.”

Ampere also calls on broadcasters to prioritize transitioning audiences to streaming, including investing in VOD services, expanding content lineups, enhancing digital ad capabilities and using innovative release strategies.

Neil Anderson, senior analyst at Ampere Analysis, noted: “Despite the short-term benefits of cutting costs during economic downturn, prioritizing long-term investment in both content and streaming capabilities is crucial for commercial broadcasters to maintain prominence in Europe’s cutthroat TV market.”