The U.S. streaming landscape remains strong but subscription fatigue and rising competition from social media content are hampering growth going forward, according to the 2024 Global Streaming Study from consultancy firm Simon-Kucher.

Per the study, a whopping 42 percent of U.S. streaming subs plan to scale back subscription spending in the next 12 months. And it’s not just about cost-cutting as users flock to social media content to serve their entertainment needs.

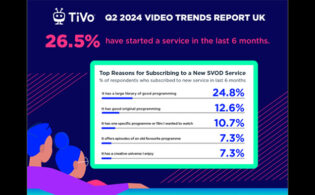

“Subscription fatigue is a growing phenomenon among U.S. subscribers, with 42 percent planning to cancel at least one subscription in the next year and more than half of those planning to do so for content-related reasons,” said Michelle Verwest, partner of technology, media and telecom at Simon-Kucher. “The message is clear: providers need to win over audiences by offering unique content, while simultaneously exploring commercial levers to drive revenue, such as bundling and ad-supported plans.”

Paid subs account for 51 percent of streaming time in the U.S., the study found, a gain of 11 percentage points from last year. Use of free online services fell by 3 percentage points.

The report also found that 37 percent of respondents have replaced potential streaming time with social media. This is even higher—52 percent—for the 18 to 39 set. Short-form content is as entertaining as streaming series and movies for 42 percent of respondents.

The annual report also found a slight increase in the average number of streaming services per user, from 3.2 to 3.6, partially driven by password sharing crackdowns. However, 45 percent of subs believer they have too many services.

Ad-supported tiers are seeing significant traction, serving as a key tool for preventing churn among price-sensitive subscribers. These are particularly effective when the advertising is personalized to the user. Bundling is also key.

“The streaming landscape is continuously evolving, and content remains the primary differentiator,” added Jaeger. “Providers must strategically adapt to these trends. They need robust content offerings capitalizing on new commercial levers to stay competitive and cater to shifting consumer preferences.”