European customers are spending an average of €696 ($741.2) annually on SVOD services, according to a new study, a fair bit less than their American counterparts ($919.1).

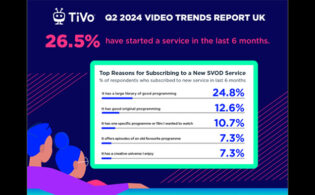

Bango surveyed 5,000 subs across the U.K., Germany, France, Italy and Spain to chart the developments in the region’s SVOD landscape. It found that 42 percent are canceling a service due to price increases (this is at 48 percent in Italy), and 60 percent say they can’t afford all the services they want. That number is even higher in Spain, at 65 percent.

“Services are responding to consumer cost concerns with flexible pricing,” the report notes. “Ad-tiering is one way to offer more affordability, with companies standing to gain from the advantages of targeted connected TV advertising over traditional broadcast channels. However, the jury is out on whether advertising can bring a reliable—and growing—source of revenue in the long term.”

The report found that 31 percent of subs downgraded to a cheaper ad tier since it was introduced, while 26 percent upgraded their sub and 29 percent canceled.

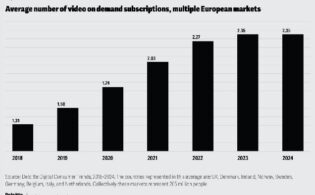

The average European subscriber uses 3.2 services, whereas the American average is 4.5. Sports was a key driver this year, with 22 percent saying they’d sign up for a service to watch the Euros earlier this year, and 20 percent doing so for the Olympics, F1, Tour de France and Wimbledon were also drivers of new subscriptions.

Customers in the region believe that there are now too many services; 65 percent say there are too many to choose from and 46 percent want all subs to be managed in one place. Bundling is key to solving this issue, the report notes; 58 percent of subs want a single app to manage all of their accounts. In Spain, this rises to 67 percent.

“The benefits for subscription service providers are loud and clear,” Bango said. “Not only would almost half (46 percent) of subscribers spend more time engaging with their subscriptions—increasing the opportunity for cross and up-selling by providers—40 percent would also sign up for more services if an all-in-one subscription platform was available.”

The report continues, “For telcos and content providers, Super Bundling could be the key to preventing customer churn. Super Bundling boosts customer spend, loyalty and advocacy. Over a third of subscribers (38 percent) would pay a higher bill if a package of popular subscriptions was automatically included, with 35 percent of subscribers willing to pay 25 percent more.