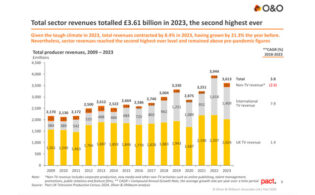

Boosted by gains in online advertising, the U.K. is set to become Europe’s largest media and entertainment market, overtaking Germany, in 2025, according to PwC’s latest Global Entertainment & Media (E&M) Outlook 2024-2028.

Entertainment and media revenues in the U.K. are expected to top £100 billion ($128.5 billion) this year, rising to £121 billion ($155.4 billion) in 2028, a 4 percent compound annual growth rate (CAGR).

“The U.K. entertainment and media industry has always been at the forefront of technological disruption,” said Mary Shelton Rose, partner and U.K. technology, media and telecoms leader at PwC. “To capitalize on the many growth opportunities, it must leverage the power of new and emerging technologies such as GenAI, reshape its business and creative models, and better leverage technology for advertising. So far, many of the applications of GenAI in the E&M industry have focused on speed and efficiency cost savings. As we look ahead, the industry should further explore how GenAI can lead to greater value creation through experimenting, iterating, and scaling new solutions and processes, which can be monetized to drive top-line revenue growth.”

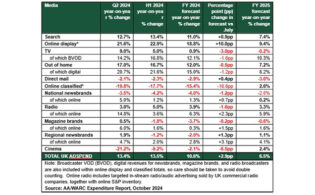

Advertising accounts for 39 percent of U.K. entertainment and media revenues this year, as compared with 29 percent across Western Europe. Digital dominates at 80 percent of the ad pie in the U.K., versus 66 percent across the region. U.K. digital advertising is expected to rise from £32 billion ($41.1 billion) this year to £44 billion ($56.5 billion) in 2028, an 8 percent CAGR.

Dan Bunyan, partner at PwC Strategy&, noted, “The U.K. is one of the most online-heavy advertising markets in the world. This relative maturity means that the U.K. internet advertising market is more sensitive to macroeconomic factors. Even so, the market is still expected to grow over the next four years with paid search supported by rapid gains in retail media, and video supporting growth. AI is expected to increasingly influence how ad content is created, placed and measured, spanning various channels.”

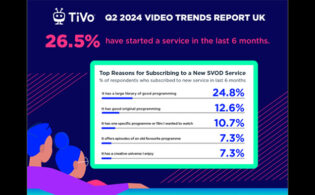

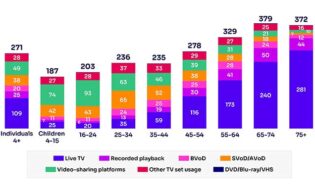

The U.K.’s streaming market ranks as the largest in Western Europe and the third biggest globally in terms of revenues after the U.S. and China, even amid slowing growth. The volume of subs per home rose at a 20 percent CAGR from 2019 to 2024; this will plummet to 3 percent from 2024 to 2028. By 2028, subs revenues will hit £8.3 billion ($10.7 billion), up from £6.5 billion ($8.4 billion), a 6 percent CAGR. “This plateauing effect is pushing leading streamers to reshape their business models and find new revenues beyond subscriptions, including the introduction of ad-based variants (reduced subscription fees with ad-filled content), cracking down on password sharing, introduction of live sports and industry consolidation,” PwC notes. Advertising will account for 30 percent of subs revenues by 2028, up from 24 percent this year.

Ben Bird, entertainment and media sector leader at PwC UK, commented, “Despite the OTT market being extremely competitive and mature, revenue has expanded rapidly in recent years with the market nearly doubling in size since 2020—thanks in part to the accelerated growth experienced during the pandemic. Prices have risen for several major platforms and despite the difficult macroeconomic environment, the market has continued to flourish. Operators are leveraging their content rights and original productions to boost take up, leaving consumers needing to subscribe to multiple services or rotate platforms to access the content they desire, such as sports streaming with English Premier League football spread across three different streaming platforms. The option to have ad-supported plans is also driving growth, in some cases offering the chance to subscribe for slightly less.”

Bird continued, “Continued growth in consumer spend on online platforms such as for gaming and streaming, together with offline environments like cinema and live music, highlight that consumers continue to seek engaging content experiences—regardless of the means of consumption. Investment in high-quality content remains critical for the U.K. E&M economy to maintain its leading position in Western Europe.”