Global ad revenues will be down by 5.8 percent this year, GroupM projects in its latest This Year, Next Year report, an improvement on the June forecast of an 11.9 percent drop in 2020.

Meanwhile, 2021 should bring 12.3 percent increase in ad revenues, up from the previous forecast of 8.2 percent growth.

Of the eight largest ad markets—the U.S., China, Japan, the U.K., Germany, France, South Korea and Canada—all but China will see declines this year. China is projected for a 6.2 percent increase. In 2021, GroupM forecasts growth for all eight markets: 11.8 percent in the U.S., 15.6 percent in China, 12 percent in Japan, 12.4 percent in the U.K., 4.6 percent in Germany, 7.2 percent in France, 1.6 percent in South Korea and 15.1 percent in Canada.

By region, Europe and Central Asia will see a decline of 8.4 percent this year, rebounding by 8.3 percent next year. AsiaPac will experience a 2-percent decline this year, with a 14.1 percent gain in 2021. MEA is forecast to take a 16.5 percent hit in 2020, increasing by 11.8 percent in 2021. Excluding political spending, North America should fall by 7.4 percent this year before rebounding to 11.7 percent growth next year. Other parts of the Americas will experience a 16 percent decline in 2020, with a 24.4 percent gain next year.

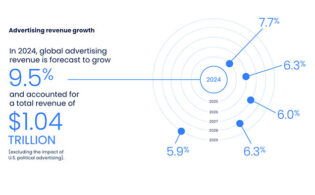

This Year, Next Year: Global 2020 End-of-Year Forecast Report highlights digital advertising as a key growth area, rising by 8.2 percent this year, excluding U.S. political advertising. By 2024, digital advertising will have a 66 percent share globally, up from 61 percent in 2021.

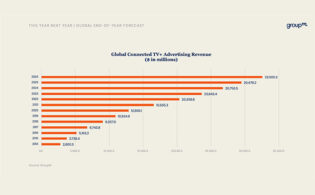

Television will be down by 15.1 percent in 2020, excluding U.S. political advertising. A rebound of 7.8 percent is expected in 2021. Digital extensions and related media, including advertising associated with traditional media owners’ streaming activities, will grow 7.8 percent this year and 23.2 percent next year.