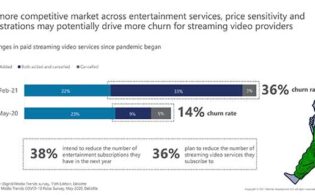

In its 2022 TMT Predictions report, Deloitte projects at least 150 million SVOD paid streaming subscriptions will be canceled worldwide next year, with churn rates rising up to 30 percent per market.

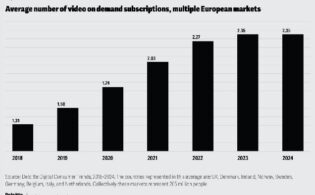

Deloitte goes on to note that more subscriptions will be added than canceled, and the average number of subs per person will increase. Further, in markets with the highest churn, many of those canceling may resubscribe to a service that they had previously left.

“These are all signs of a competitive and maturing SVOD market,” the report notes. “As SVOD matures, growth across global regions that may have different cost sensitivities will likely require different business model innovation and pathways to profitability.”

With competition intensifying, subscriber acquisition costs for SVODs will rise, Deloitte explains, with some spending up to $200 to acquire each new customer. SVOD churn rates have been highest in the mature U.S. market, where some consumers have “become overwhelmed by managing and paying for all those subscriptions, and they have become more sensitive to their cost. These conditions can drive customers to cancel subscriptions and/or seek less expensive ad-supported offerings, both to manage costs and as a way to pay only for the content they want by adding and canceling services as needed.” The U.S. churn rate stands at about 35 percent, and providers are looking at pricing as a key way to keep cancelation rates down.

In Europe, churn ranged from 7 percent (Belgium) to 23 percent (Norway) as of the middle of last year. Looking ahead to 2022, Deloitte expects churn to rise but still stay under 25 percent.

AVOD options are proving particularly popular in Latin America and AsiaPac, Deloitte adds. “The Asian model may inform how U.S. services can expand globally and how providers in Europe, Latin America and Africa can grow their own offerings. As SVOD matures in multiple markets, we predict that their growth will be increasingly based on ad-supported models, and that the metric for SVOD success will be less about subscriber count and more about overall revenue from all services and sources. This may favor media companies that offer more than just streaming video.”

Going forward, platforms will have to remain focused on keeping churn rates under control, Deloitte says. “The cost of content development and acquisition is unlikely to decline, and the pressures to acquire and retain audiences will persist. To succeed, SVOD providers should work to better understand their customers and their lifetime value, develop more options for different audience segments, and offer value across an array of entertainment options.”

This includes more pricing tiers, including ad-supported and ad-subsidized, with premium subs given access to exclusive content, as well as reward programs. Leveraging partnerships with telcos or cable TV operators will also be important, especially in mobile-first markets.

“SVOD’s success was built on offering a flexible alternative to the costs and constraints of pay TV, and consumers are not likely to relinquish the freedom they have become accustomed to in assembling their own select baskets of entertainment. SVOD providers’ ultimate success will likely lie in building a nuanced and granular relationship with consumers to deliver ongoing value—not finding ways to make it harder for them to leave.”