DURHAM: A new report from Digitalsmiths on pay-TV subscribers has found that many are overwhelmed with the volume of channels available and do not feel it’s easy to find the content they want to watch.

The company queried more than 3,000 people aged 18 and up in the U.S. and Canada if they plan to switch pay-TV providers in the next six months for the Q2 2016 Video Trends Report: 7.2 percent plan to cut their service, 7 percent plan to switch providers, 3.7 percent want to move to an online service or app and 31.8 percent are on the fence. Of those who plan to cut the cord or switch to another provider, almost half would stay if their platform added new functionality to make it easier to find the content they want to watch.

The majority of survey respondents (49.1 percent) are shelling out between $51 and $100 per month for cable and satellite services and 34.9 percent are paying more than $100. For 40.1 percent of respondents, prices have gone up in the last 12 months.

The majority of respondents (77.2 percent) are either “satisfied” or “very satisfied” with their existing service. For those dissatisfied, the main reasons are cost, “bad channel selection” and poor service.

Another key finding is that 41.2 percent of respondents are paying for one or more premium channels, a slight increase on last year, with HBO, Showtime and The Movie Channel listed as the top services, followed by sports packages, Cinemax and Starz.

The study also found strong interest in skinny bundles, with 76.8 percent of respondents preferring to select channels they want; this figure is however down by 2.6 percent on a year ago. The top five most-desired channels are Discovery, ABC, CBS, HISTORY and NBC. An ideal lineup would consist of about 19 channels, costing about $41.04 a month.

The report identifies frustration with channel volume—32.3 percent of survey takers feel overwhelmed by the number of channels available, and 87 percent watch the same channels over and over again. Moreover, 83.1 percent watch fewer than 10 channels.

Digitalsmiths also explored viewing habits, finding that 43.9 percent of respondents watch between one and three hours of TV a day; and 47.3 percent spend between 5 and 20 minutes channel surfing to find something to watch.

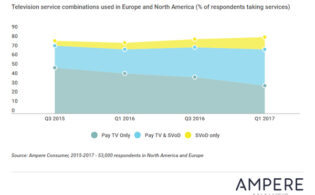

The report also points to a rise of so-called “cord-cheating,” referring to “cable/satellite subscribers who seek on-demand video content from third-party and OTT services as an alternative to pay-TV providers’ offering.” This includes SVOD and TVOD. In Q2, 57.2 percent of respondents who are pay-TV subscribers are “cord-cheaters,” a 2.8 percent increase. Of these, 92.1 percent use SVOD, 51.1 percent use TVOD (down slightly on the previous quarter) and 43.2 percent use both.

SVOD subs are considerably happier about finding content—81.6 percent feel it’s easy to find something to watch, compared with just 57.7 percent of pay-TV subs. “One unifying trend that contributes to the popularity of SVOD services is their intuitive, personalized, modern interfaces and viewing experiences,” the report says.

Most SVOD subscribers (55.9 percent) are spending between $6 and $14 a month. Digitalsmiths explored Netflix pricing, finding that 39.1 percent of respondents would not pay more than $12 to $15 for the service. The company also found that 10.4 percent of respondents are not paying for an SVOD service but are sharing access with another person. On the TVOD side, the most used services are Amazon, Redbox Kiosks and iTunes.

Exploring why respondents use OTT services, the number one reason was convenience, followed by the lack of advertising, monthly cost, ability to watch specific shows and entire seasons, and having access to a better selection.