The big six global SVOD platforms will invest $42 billion in original and acquired content this year, a 7 percent gain—as compared with the 24 percent growth recorded last year—according to a new Ampere Analysis study.

Gains continue to be led by the priority original genres of crime/thrillers, sci-fi/fantasy and comedy, Ampere said, but acquisitions and cost management will be the key goals of platforms heading into 2024.

Scripted remains the most dominant genre, accounting for 90 percent of this year’s projected $42 billion spend. Of that, about $12 billion will be spent on crime/thrillers. “High-budget scripted TV content remains the most powerful tool for attracting subscriptions and maintaining subscriber engagement,” Ampere said. Netflix and Prime Video are expected to have a more balanced approach to genre allocation than the likes of Apple TV+, where about 40 percent of the budget goes on crime/thrillers, and Disney+, which has prioritized sci-fi/fantasy and children’s and family content.

While scripted takes the bulk of budgets, streamers are turning to entertainment and reality as they try to minimize spend. Ampere projects that global streamers will spend $4.9 billion on unscripted content this year, a 22 percent increase. Dating, talk and game-show formats are increasingly in demand.

Content acquisition spend is expected to rise by 5 percent this year to $14.8 billion as streamers rethink their original strategies. Crime, romance and drama lead in acquired content spending.

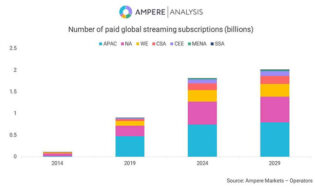

Neil Anderson, senior analyst at Ampere Analysis, said: “In 2023, we forecast that major global SVOD platforms will collectively invest $42 billion in film and TV content. The moderated spending growth rate in comparison to previous years underscores the maturity of the SVOD market and the importance of strategic spending across genres. At $15 billion, Netflix will retain its position as the top investor in global streaming content, albeit with a modest 2 percent increase. Meanwhile, rivals such as Disney+, Paramount+ and Apple TV+ are poised for more substantial budget expansions, projecting year-on-year increases exceeding 10 percent.”