A new Ampere Analysis report on Netflix originals forecasts that Poland is in line for increased local content.

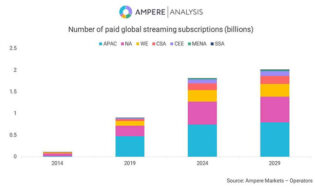

Between Q4 2019 and Q3 2020, North American commissions accounted for 55 percent of Netflix original titles, according to the report. This share fell to 45 percent between Q4 2020 and Q3 2021—despite the fact that North American commissions increased in volume—as Netflix continued to ramp up investment internationally.

Ampere has compared the link between Netflix’s subscriber base and its catalog of local titles to illustrate where the streamer has an opportunity to expand local libraries. It has identified Poland and Turkey as markets where Netflix is underweight for local original content.

The methodology follows that markets localized in the last three to four years—such as South Korea, Mexico and South America—display a common formula in local content acquisition and original projects. First, there is an acceleration in the acquisition of third-party titles, small trials of local commissions and then a wider rollout of original local production. The wider rollout begins with a high proportion of movie commissions and is then followed by a steady flow of series activity. After 24 months, there’s a second surge in commissions.

Poland, Ampere asserts, offers Netflix a comparable market size to some secondary Latin American and Western European territories. Netflix has recently expanded the volume of local third-party titles on offer in the territory. It has begun the local commissioning process in Poland, with a spike in commissioning in Q1 2021, with four new films and four TV shows. Based on patterns seen in other markets, and the current slate of Polish originals and acquisitions, Ampere estimates that Netflix is likely to commission a further 16 titles over the next two years (including four more original films), in addition to further expanding its current third-party local catalog.

Richard Cooper, research director at Ampere Analysis, said: “Between Q4 2019 and Q3 2021, Netflix increased the volume of original titles being commissioned, with international now the focus of activity. This strategy outstrips that of its international competitors, due to Netflix’s relative maturity and the company’s drive to acquire ever more subscribers. The increase in commissioning outside the U.S. underscores the importance of international markets to Netflix’s continued global expansion.”