Advertising and subscription revenues in the premium VOD sector in India hit $1.04 billion in the first half of this year, a 38 percent gain on the same period last year, according to new research from Media Partners Asia (MPA).

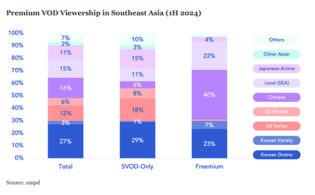

Local content dominates the sector, accounting for a whopping 86 percent of premium VOD engagement in the period, driven by live sports (36 percent) and drama and romance series (25 percent). Sports content accounted for nine of the top 15 titles, led by cricket. American content had a 5 percent share of engagement, with Korea at 2 percent.

The report uses data from MPA’s ampd measurement platform, which logged 8 million minutes streamed across all online video services in India, including YouTube. The free video sharing site secured 92 percent of all online video consumption, with premium VOD (AVOD, freemium and SVOD) landing just an 8 percent share. Of the premium VOD sector, freemium led with 92 percent of the 645 billion minutes streamed.

In terms of monetization, the leaders are Jio Cinema, Netflix and Disney+ Hotstar, which accounted for 70 percent of all revenues generated in the premium VOD sector. Premium VOD advertising is led by Jio Cinema and Disney+ Hotstar. Total SVOD subs rose in the period to 120 million.

Mihir Shah, VP of MPA India, noted: “Subscriber growth momentum will continue in 2H 2024, driven by aggregation and deeper partnerships with telcos, pay-TV operators, and OEMs. In addition, with the onset of the festive season, advertising spending should be robust in Q4 2024. However, with no major sports events, spending will shift toward tentpole non-fiction shows on premium VOD platforms, with a significant portion moving back to high-reach UGC platforms. Netflix and Prime Video have a steady stream of content planned for 2H 2024. For freemium platforms, entertainment spends have started to come back under new advertising-friendly formats like TV++, which are similar to daily TV soap operas with 40 to 120-plus episodes per season. These formats have proven to attract new users and drive engagement with lower budgets.”